- HIGHLIGHTS OF THIS ISSUE

- Part I

- Part III

- Part IV

- Deletions From Cumulative List of Organizations, Contributions to Which are Deductible Under Section 170 of the Code

- Definition of Terms

- Numerical Finding List1

- Finding List of Current Actions on Previously Published Items1

- How to get the Internal Revenue Bulletin

Internal Revenue Bulletin: 2023-31

July 31, 2023

These synopses are intended only as aids to the reader in identifying the subject matter covered. They may not be relied upon as authoritative interpretations.

This revenue procedure provides specifications for the private printing of red-ink substitutes for the 2023 Forms W-2 and W-3. This revenue procedure will be produced as the next revision of Publication 1141. Rev. Proc. 2022-30 is superseded.

26 CFR 601.602: Tax forms and instructions. (Also Part I, Sections 6041, 6051, 6071, 6081, 6091; 1.6041-1, 1.6041-2, 31.6051-1, 31.6051-2, 31.6071(a)-1, 31.6081(a)-1, 31.6091-1.)

The notice provides transition relief in connection with the change to the required beginning date of required minimum distributions (RMDs) from IRAs and employer plans pursuant to section 107 of the SECURE 2.0 Act of 2022, enacted on December 29, 2022, as Division T of the Consolidated Appropriations Act, 2023, Pub. L. 117-328, 136 Stat. 4459 (2022). In addition, this notice provides guidance related to certain provisions of section 401(a)(9) that apply for 2021, 2022, and 2023, and the related excise tax under section 4974. Finally, the notice announces that the final regulations intended to be published relating to RMDs will apply for purposes of determining RMDs for calendar years beginning no earlier than 2024.

Section 2303 of the “Coronavirus Aid, Relief, and Economic Security Act,” Pub. L. No. 116-136, 134 Stat. 281 (March 27, 2020) (the “CARES Act”), amended the carryback provisions related to net operating losses. As a result of the CARES Act amendments, which specifically extended the carryback period for certain net operating losses, temporary regulations were issued on July 2, 2020, permitting certain acquiring consolidated groups to elect to waive all or a portion of the pre-acquisition portion of the extended carryback period under section 172 for certain losses attributable to certain acquired members. These final regulations adopt without substantive change those temporary regulations.

26 CFR 1.1502-21: Carryback of Consolidated Net Operating Losses

Rev. Proc. 2023-3, 2023-1 I.R.B. 144 (January 3, 2023) contains an error in the second 2022-19, 2022-42 I.R.B. 282, is superseded. However, Rev. Proc. 2022-19, 2022-42 I.R.B. 282 remains in effect and is not superseded. Section 7 is corrected to read, “Rev. Proc. 2022-3, 2022-1 I.R.B. 144, is superseded. Rev. Proc. 2022-28, 2022-27 I.R.B. 65, is superseded.

Provide America’s taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.

The Internal Revenue Bulletin is the authoritative instrument of the Commissioner of Internal Revenue for announcing official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest. It is published weekly.

It is the policy of the Service to publish in the Bulletin all substantive rulings necessary to promote a uniform application of the tax laws, including all rulings that supersede, revoke, modify, or amend any of those previously published in the Bulletin. All published rulings apply retroactively unless otherwise indicated. Procedures relating solely to matters of internal management are not published; however, statements of internal practices and procedures that affect the rights and duties of taxpayers are published.

Revenue rulings represent the conclusions of the Service on the application of the law to the pivotal facts stated in the revenue ruling. In those based on positions taken in rulings to taxpayers or technical advice to Service field offices, identifying details and information of a confidential nature are deleted to prevent unwarranted invasions of privacy and to comply with statutory requirements.

Rulings and procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents. Unpublished rulings will not be relied on, used, or cited as precedents by Service personnel in the disposition of other cases. In applying published rulings and procedures, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered, and Service personnel and others concerned are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same.

The Bulletin is divided into four parts as follows:

Part I.—1986 Code. This part includes rulings and decisions based on provisions of the Internal Revenue Code of 1986.

Part II.—Treaties and Tax Legislation. This part is divided into two subparts as follows: Subpart A, Tax Conventions and Other Related Items, and Subpart B, Legislation and Related Committee Reports.

Part III.—Administrative, Procedural, and Miscellaneous. To the extent practicable, pertinent cross references to these subjects are contained in the other Parts and Subparts. Also included in this part are Bank Secrecy Act Administrative Rulings. Bank Secrecy Act Administrative Rulings are issued by the Department of the Treasury’s Office of the Assistant Secretary (Enforcement).

Part IV.—Items of General Interest. This part includes notices of proposed rulemakings, disbarment and suspension lists, and announcements.

The last Bulletin for each month includes a cumulative index for the matters published during the preceding months. These monthly indexes are cumulated on a semiannual basis, and are published in the last Bulletin of each semiannual period.

DEPARTMENT OF THE TREASURY Internal Revenue Service 26 CFR Parts 1 and 602

Carryback of Consolidated Net Operating Losses

AGENCY: Internal Revenue Service (IRS), Treasury.

ACTION: Final regulations; removal of temporary regulations.

SUMMARY: This document contains final regulations that affect corporations filing consolidated returns. These regulations permit consolidated groups that acquire new members that were members of another consolidated group to elect in a year subsequent to the year of acquisition to waive all or part of the pre-acquisition portion of the carryback period for certain losses attributable to the acquired members where there is a retroactive statutory extension of the net operating loss (NOL) carryback period. This document finalizes certain provisions in proposed regulations that were published on July 8, 2020, and removes temporary regulations published on the same date.

DATES: Effective date: These final regulations are effective on July 10, 2023.

Applicability date: For the date of applicability, see §1.1502-21(h)(9).

FOR FURTHER INFORMATION CONTACT: Stephen R. Cleary at (202) 317-5353 (not a toll-free number).

SUPPLEMENTARY INFORMATION:

This Treasury decision amends the Income Tax Regulations (26 CFR part 1) under section 1502 of the Internal Revenue Code (Code). Section 1502 authorizes the Secretary of the Treasury or her delegate (Secretary) to prescribe regulations for an affiliated group of corporations that join in filing (or that are required to join in filing) a consolidated return (consolidated group, as defined in §1.1502-1(h)) to clearly reflect the Federal income tax liability of the consolidated group and to prevent avoidance of such tax liability. For purposes of carrying out those objectives, section 1502 also permits the Secretary to prescribe rules that may be different from the provisions of chapter 1 of the Code that would apply if the corporations composing the consolidated group filed separate returns. Terms used in the consolidated return regulations generally are defined in §1.1502-1.

On July 8, 2020, the Department of the Treasury (Treasury Department) and the IRS published a notice of proposed rulemaking (REG-125716-18) in the Federal Register (85 FR 40927) under section 1502 (2020 proposed regulations). The 2020 proposed regulations provided guidance that, in part, implemented amendments to section 172 under Public Law 115-97, 131 Stat. 2054 (Dec. 22, 2017), commonly known as the Tax Cuts and Jobs Act (TCJA), and the Coronavirus Aid, Relief, and Economic Security Act (CARES Act), Public Law 116-136, 134 Stat. 281 (Mar. 27, 2020). Specifically, the 2020 proposed regulations provided guidance for consolidated groups regarding (i) the application of the 80-percent limitation in section 172(a)(2), as originally enacted as part of the TCJA and subsequently amended by the CARES Act, and (ii) the absorption of NOL carrybacks and carryovers.

In connection with the 2020 proposed regulations, the Treasury Department and the IRS published on the same date temporary regulations (TD 9900) in the Federal Register (85 FR 40892) under section 1502 (2020 temporary regulations). The Treasury Department and the IRS issued the 2020 temporary regulations to provide guidance to consolidated groups regarding the application of the NOL carryback rules under section 172(b), as amended by (i) section 2303(b) of the CARES Act, and (ii) any similar future statutory amendments to section 172. Specifically, if there is a retroactive statutory extension of the NOL carryback period under section 172 (retroactive statutory extension), the 2020 temporary regulations permit consolidated groups that, before the enactment of the retroactive statutory extension, acquired new members that were members of another consolidated group to elect to waive, in a taxable year subsequent to the taxable year of the acquisition, all or part of the pre-acquisition portion of the carryback period for consolidated net operating losses (CNOLs) attributable to the acquired members. The preamble to the 2020 temporary regulations includes a background discussion of the rules regarding NOL carrybacks and carryovers under section 172 and the related consolidated return regulations. Part II of this Background describes the 2020 temporary regulations in greater detail.

A correction to the 2020 temporary regulations was published in the Federal Register (85 FR 53162) on August 28, 2020. The text of the 2020 temporary regulations also serves as the text of §1.1502-21(b)(3)(ii)(C) and (D) of the 2020 proposed regulations.

The 2020 proposed regulations, other than proposed §1.1502-21(b)(3)(ii)(C) and (D), were adopted as final regulations on October 27, 2020. See TD 9927 (85 FR 67966).

The IRS received one comment in response to the 2020 temporary regulations. A copy of the comment is available for public inspection at https://www.regulations.gov (type IRS-2020-0020 in the search field on the https://www.regulations.gov homepage) or upon request. No public hearing was requested or held.

As described in greater detail in the Summary of Comment and Explanation of Revisions, the Treasury Department and the IRS have considered the commenter’s recommendations and concluded that their adoption would necessitate conforming changes to the split-waiver election provisions set forth in §1.1502-21(b)(3)(ii)(B) (general split-waiver election), which are beyond the scope of this guidance. Therefore, the Treasury Department and the IRS have determined that, aside from non-substantive revisions to incorporate the rules regarding retroactive statutory extensions into §1.1502-21(b), improve readability, and make other perfecting edits, §1.1502-21(b)(3)(ii)(C) and (D) of the 2020 proposed regulations should be adopted as final regulations without change, and that the 2020 temporary regulations should be removed. The Treasury Department and the IRS continue to study the commenter’s recommendations for purposes of potential future guidance.

On prior occasions, enacted legislation has amended section 172 to retroactively extend the carryback period for NOLs. See Worker, Homeownership, and Business Assistance Act of 2009, Public Law 111-92, 123 Stat. 2984 (November 6, 2009); Job Creation and Worker Assistance Act of 2002, Public Law 107-147, 116 Stat. 21 (March 9, 2002). Most recently, section 2303(b) of the CARES Act added section 172(b)(1)(D) to the Code. Section 172(b)(1)(D) requires (in the absence of a waiver under section 172(b)(3)) a five-year carryback period for an NOL that arises in a taxable year beginning after December 31, 2017, and before January 1, 2021.

Such retroactive statutory extensions of NOL carryback periods uniquely impact a consolidated group (acquiring group) that acquires one or more corporations (acquired member) before the enactment of the retroactive statutory extension of the carryback period. During the past two decades, the Treasury Department and the IRS have provided an acquiring group with certain additional elections for waiving carrybacks of losses into another consolidated group of which an acquired member previously was a member (former group). See 75 FR 35643 (June 23, 2010) (2010 split-waiver regulations); 67 FR 38000 (May 31, 2002) (2002 split-waiver regulations). These additional elections, while responsive to particular retroactive statutory extensions, have reflected common policy objectives of providing affected groups with the ability to waive all or a portion of the NOL carryback period of acquired members extended by retroactive statutory extensions applicable before, but enacted after, the acquisition(s).

The Treasury Department and the IRS determined that it is appropriate to provide similar rules with regard to the NOL carryback rules retroactively amended by section 2303(b) of the CARES Act in particular, or by future legislation enacting retroactive statutory amendments to NOL carryback rules more generally. Therefore, the 2020 temporary regulations provided principle-based rules, referred to in these regulations as “amended carryback rules,” applicable to CNOLs arising in taxable years to which amended carryback rules become applicable after the acquisition of a member. Under these rules, an acquiring group possesses the opportunity to waive, on a taxable-year-by-taxable-year basis, all or a portion of the carryback period with regard to CNOLs attributable to acquired members for pre-acquisition years during which the acquired members were members of a former group.

The 2020 temporary regulations provide two types of split-waiver elections for consolidated groups that (i) include one or more acquired members, and (ii) have CNOLs that, under amended carryback rules, become eligible to be carried back for a greater number of years than under statutory law in effect at the time of the acquisition (default carryback period). One type of election (amended statute split-waiver election) permits an acquiring group to relinquish that part of the carryback period during which an acquired member was a member of a former group (for the portion of a CNOL attributable to the acquired member), even though the acquiring group did not file a split-waiver election for the year in which the acquired member became a member of the acquiring group (as required by §1.1502-21(b)(3)(ii)(B)). See §1.1502-21T(b)(3)(ii)(C)(2)(v). The other type of election (extended split-waiver election) applies solely to the extended carryback period (that is, the additional carryback years provided under amended carryback rules). Through an extended split-waiver election, an acquiring group can ensure that amended carryback CNOLs are carried back to taxable years of former groups only to the extent those losses would have been carried back under prior law (that is, limiting CNOL carrybacks to the default carryback period). See §1.1502-21T(b)(3)(ii)(C)(2)(ix). These two additional types of split-waiver elections provide relief, and are subject to conditions and procedures, consistent with the applicable split-waiver elections set forth in the 2002 and 2010 split-waiver regulations.

The Treasury Department and the IRS received one comment that recommended two changes to the split-waiver election provisions set forth in the 2020 temporary regulations (2020 split-waiver elections).

As discussed in the preamble to the 2020 temporary regulations, a general split-waiver election and the 2020 split-waiver elections may be made only with respect to the portion of the carryback period for which the acquired member was a member of a former group. Thus, such an election would not be effective with respect to any portion of the carryback period during which the acquired member was a stand-alone corporation. The commenter recommended that split-waiver elections be available whenever a portion of a CNOL attributable to an acquired member would be carried back to a separate return year, regardless of whether the acquired member was a member of a former group or a stand-alone corporation in that carryback year.

The commenter also suggested that, although the rules governing split-waiver elections are too narrow insofar as they exclude acquisitions of stand-alone corporations, such rules also are too broad insofar as they apply to situations in which the acquired member was the common parent of a former group (whole-group acquisitions). See §1.1502-21(b)(3)(ii)(B) (allowing the acquiring group to make a general split-waiver election with respect to the portion of the carryback period for which the acquired member was “a member of another group”); §1.1502-21T(b)(3)(ii)(C)(2)(v) and (ix) (allowing the acquiring group to make a 2020 split-waiver election with respect to the portion of the carryback period for which the acquired member was “a member of any former group”); §1.1502-1(b) (defining the term “member” to include the common parent of the group).

For example, assume that P is the common parent of Group 1 in Years 1 and 2. At the beginning of Year 3, Group 2 acquires all the stock of P. In Year 6, Group 2 incurs a CNOL, a portion of which is attributable to P. In Year 7, Congress amends section 172 by extending the carryback period for NOLs arising in Year 6 to five years. Group 2 would be eligible to make either a general split-waiver election (if it filed the requisite statement with its Federal income tax return for Year 3) or one of the 2020 split-waiver elections. The commenter contended that a split-waiver election should not be available in such a situation because disputes regarding NOL carrybacks should not arise between the former group and the acquiring group (which controls the former group after the acquisition).

The changes recommended by the commenter, if adopted, would necessitate revisions not only to the 2020 split-waiver elections, but also to the general split-waiver election provisions in §1.1502-21(b)(3)(ii)(B). Both the general split-waiver election and the 2020 split-waiver elections may be made only with respect to the portion of the carryback period for which the acquired member was a member of a former group. Moreover, both the general split-waiver election and the 2020 split-waiver elections may apply to situations in which the acquired member was the common parent of a former group (that is, whole-group acquisitions). Consequently, after considering the comment, the Treasury Department and the IRS have determined that the scope of the changes suggested by the commenter exceed the scope of §1.1502-21(b)(3)(ii)(C) and (D) of the 2020 proposed regulations.

Thus, as noted in part I of the Background, the Treasury Department and the IRS have concluded that the split-waiver election provisions provided by the 2020 proposed regulations should be adopted without substantive change. The Treasury Department and the IRS continue to study the commenter’s recommendations for purposes of potential future guidance. Accordingly, the final regulations contained in this Treasury decision adopt the provisions of §1.1502-21(b)(3)(ii)(C) and (D) of the 2020 proposed regulations without substantive change.

Although no substantive changes are made to the rules of §1.1502-21(b)(3)(ii)(C) and (D) of the 2020 proposed regulations, the final regulations make the following non-substantive changes to incorporate those rules into §1.1502-21(b) and to improve readability: (1) the provisions of §1.1502-21(b)(3)(ii)(A) have been redesignated as §1.1502-21(b)(3)(ii); (2) the provisions of §1.1502-21(b)(3)(ii)(B) have been redesignated as §1.1502-21(b)(4); (3) the provisions of §1.1502-21(b)(3)(ii)(C) and (D) of the 2020 proposed regulations have been redesignated as §1.1502-21(b)(5) and (6); (4) the provisions of §1.1502-21(b)(3)(iii) have been redesignated as §1.1502-21(b)(7); (5) the provisions of §1.1502-21(b)(3)(iv) and (v) have been removed; and (6) corresponding perfecting edits have been made.

Pursuant to the Memorandum of Agreement, Review of Treasury Regulations under Executive Order 12866 (June 9, 2023), tax regulatory actions issued by the IRS are not subject to the requirements of section 6(b) of Executive Order 12866, as amended. Therefore, a regulatory impact assessment is not required.

The collections of information in these final regulations are in §1.1502-21(b)(5)(v)(A) and (B). The information is required to inform the IRS on whether, and to what extent, an acquiring group makes either of the elections described in these final regulations.

The collection of information provided by these final regulations has been approved by the Office of Management and Budget (OMB) under control number 1545-0123. For purposes of the Paperwork Reduction Act, 44 U.S.C. 3501 et seq. (PRA), the reporting burden associated with the collection of information in Form 1120, U.S. Corporation Income Tax Return, will be reflected in the PRA Submission associated with OMB control number 1545-0123.

In general, if the acquiring group makes an election under §1.1502-21(b)(5), the acquiring group is required to attach a separate statement to its Form 1120 as provided in §1.1502-21(b)(5)(v)(A) and (B), respectively. This statement must be filed as provided in §1.1502-21(b)(5)(vi).

The following table displays the number of respondents estimated to be required to report on Form 1120 with respect to the collections of information required by these final regulations. Due to the absence of historical tax data, direct estimates of the number of respondents required to attach a statement to other types of tax returns, as applicable, are not available.

| Number of Respondents (Estimated) | |

|---|---|

| Amended Statute Split-Waiver Election & Extended Split-Waiver Election | |

| Form 1120 | 17,500 |

Source: RAAS:CDW

The numbers of respondents in the table were estimated by the Research, Applied Analytics, and Statistics Division (RAAS) of the IRS from the Compliance Data Warehouse (CDW). Data for Form 1120 represents estimates of the total number of taxpayers that may attach an election statement to their Form 1120 to make the elections in §1.1502-21(b)(5)(v)(A) and (B).

It is estimated that 17,500 consolidated entities will be required to attach a statement under these final regulations. The burden estimates associated with the information collections in these final regulations are included in aggregated burden estimates for the OMB control number 1545-0123. The burden estimates provided in the OMB control numbers in the following table are aggregate amounts that relate to the entire package of forms associated with the OMB control number, and will in the future include, but not isolate, the estimated burden of those information collections associated with these final regulations. To guard against over-counting the burden that consolidated tax provisions imposed prior to §1.1502-21, the Treasury Department and the IRS urge readers to recognize that these burden estimates have also been cited by regulations that rely on the applicable OMB control numbers in order to collect information from the applicable types of filers.

| Form | Type of Filer | OMB Number(s) | Status |

|---|---|---|---|

| Form 1120 | Corporation | 1545-0123 | Published in the Federal Register on 12/22/2022. Public Comment period closed on 01/19/2023. Approved by OMB through 12/31/2023. |

| Link: https://www.federalregister.gov/documents/2022/12/20/2022-27628/comment-request-us-business-income-tax-returns | |||

Source: RAAS:CDW

Pursuant to the Regulatory Flexibility Act (5 U.S.C. chapter 6), it is hereby certified that this rulemaking will not have a significant economic impact on a substantial number of small entities within the meaning of section 601(6) of the Regulatory Flexibility Act. This certification is based on the fact that these final regulations apply only to corporations that file consolidated Federal income tax returns, and that such corporations almost exclusively consist of larger businesses. Specifically, based on data available to the IRS, corporations that file consolidated Federal income tax returns represent only approximately two percent of all filers of Forms 1120, U.S. Corporation Income Tax Return. However, these consolidated Federal income tax returns account for approximately 95 percent of the aggregate amount of receipts provided on all Forms 1120. Therefore, these final regulations will not create additional obligations for, or impose an economic impact on, small entities, and a regulatory flexibility analysis under the Regulatory Flexibility Act is not required.

Pursuant to section 7805(f) of the Code, the notice of proposed rulemaking that preceded these final regulations was submitted to the Chief Counsel for the Office of Advocacy of the Small Business Administration for comment on its impact on small business. No comments on that notice of proposed rulemaking were received from the Chief Counsel for the Office of Advocacy of the Small Business Administration.

Section 202 of the Unfunded Mandates Reform Act of 1995 requires that agencies assess anticipated costs and benefits and take certain other actions before issuing a final rule that includes any Federal mandate that may result in expenditures in any one year by a State, local, or Tribal government, in the aggregate, or by the private sector, of $100 million in 1995 dollars, updated annually for inflation. These final regulations do not include any Federal mandate that may result in expenditures by State, local, or Tribal governments, or by the private sector in excess of that threshold.

Executive Order 13132 (Federalism) prohibits an agency from publishing any rule that has federalism implications if the rule either imposes substantial, direct compliance costs on State and local governments, and is not required by statute, or preempts State law, unless the agency meets the consultation and funding requirements of section 6 of the Executive order. These final regulations do not have federalism implications, do not impose substantial direct compliance costs on State and local governments, and do not preempt State law within the meaning of the Executive order.

The principal author of these final regulations is Stephen R. Cleary of the Office of Associate Chief Counsel (Corporate). However, other personnel from the Treasury Department and the IRS participated in their development.

26 CFR Part 1

Income taxes, Reporting and recordkeeping requirements.

26 CFR Part 602

Reporting and recordkeeping requirements.

Adoption of Amendments to the Regulations

Accordingly, 26 CFR parts 1 and 602 are amended as follows:

PART 1—INCOME TAXES

Paragraph 1. The authority citation for part 1 continues to read in part as follows:

Authority: 26 U.S.C. 7805 * * *

Par. 2. Section 1.1502-21 is amended by:

1. Removing the language “paragraph (b)(3)(iii)” in paragraph (b)(2)(iii) and adding the language “paragraph (b)(7)” in its place.

2. Revising paragraph (b)(3).

3. Adding paragraphs (b)(4) through (7).

4. Removing the language “(b)(3)(ii)(B)” in paragraph (h)(5) and adding the language “(b)(4)” in its place.

5. Revising paragraph (h)(9).

The additions and revisions read as follows:

§1.1502-21 Net operating losses.

* * * * *

(b) * * *

(3) Election to relinquish entire carryback period—(i) In general. A group may make an irrevocable election under section 172(b)(3) to relinquish the entire carryback period with respect to a CNOL for any consolidated return year. Except as provided in paragraphs (b)(4) and (5) of this section, the election may not be made separately for any member (whether or not it remains a member), and must be made in a separate statement titled “THIS IS AN ELECTION UNDER §1.1502-21(b)(3)(i) TO WAIVE THE ENTIRE CARRYBACK PERIOD PURSUANT TO SECTION 172(b)(3) FOR THE [insert consolidated return year] CNOLs OF THE CONSOLIDATED GROUP OF WHICH [insert name and employer identification number of common parent] IS THE COMMON PARENT.” The statement must be filed with the group’s income tax return for the consolidated return year in which the loss arises. If the consolidated return year in which the loss arises begins before January 1, 2003, the statement making the election must be signed by the common parent. If the consolidated return year in which the loss arises begins after December 31, 2002, the election may be made in an unsigned statement.

(ii) Groups that include insolvent financial institutions. For rules applicable to relinquishing the entire carryback period with respect to losses attributable to insolvent financial institutions, see §301.6402-7 of this chapter.

(4) General split-waiver election. If one or more members of a consolidated group becomes a member of another consolidated group, the acquiring group may make an irrevocable election to relinquish, with respect to all consolidated net operating losses attributable to the member, the portion of the carryback period for which the corporation was a member of another group, provided that any other corporation joining the acquiring group that was affiliated with the member immediately before it joined the acquiring group is also included in the waiver. This election is not a yearly election and applies to all losses that would otherwise be subject to a carryback to a former group under section 172. The election must be made in a separate statement titled “THIS IS AN ELECTION UNDER §1.1502-21(b)(4) TO WAIVE THE PRE-[insert first taxable year for which the member (or members) was not a member of another group] CARRYBACK PERIOD FOR THE CNOLs attributable to [insert names and employer identification number of members].” The statement must be filed with the acquiring consolidated group’s original income tax return for the year the corporation (or corporations) became a member. If the year in which the corporation (or corporations) became a member begins before January 1, 2003, the statement must be signed by the common parent and each of the members to which it applies. If the year in which the corporation (or corporations) became a member begins after December 31, 2002, the election may be made in an unsigned statement.

(5) Split-waiver elections to which amended carryback rules apply—(i) In general. An acquiring group may make either (but not both) an amended statute split-waiver election or an extended split-waiver election with respect to a particular amended carryback CNOL. These elections are available only if the statutory amendment to the carryback period referred to in paragraph (b)(5)(ii)(D) of this section occurs after the date of acquisition of an acquired member. A separate election is available for each taxable year to which amended carryback rules apply. An acquiring group may make an amended statute split-waiver election or an extended split-waiver election only if the acquiring group, with regard to that election—

(A) Satisfies the requirements in paragraph (b)(5)(iii) of this section; and

(B) Follows the procedures in paragraphs (b)(5)(v) and (vi) of this section, as relevant to that election.

(ii) Definitions. The definitions provided in this paragraph (b)(5)(ii) apply for purposes of paragraphs (b)(5) and (6) of this section.

(A) Acquired member. The term acquired member means a member of a consolidated group that joins another consolidated group.

(B) Acquiring group. The term acquiring group means a consolidated group that has acquired a former member of another consolidated group (that is, an acquired member).

(C) Amended carryback CNOL. The term amended carryback CNOL means the portion of a CNOL attributable to an acquired member (determined pursuant to paragraph (b)(2)(iv)(B) of this section) arising in a taxable year to which amended carryback rules apply.

(D) Amended carryback rules. The term amended carryback rules means the rules of section 172 of the Code after amendment by statute to extend the carryback period for NOLs attributable to an acquired member (determined pursuant to paragraph (b)(2)(iv)(B) of this section).

(E) Amended statute split-waiver election. The term amended statute split-waiver election means, with respect to any amended carryback CNOL, an irrevocable election made by an acquiring group to relinquish the portion of the carryback period (including the default carryback period and the extended carryback period) for that loss during which an acquired member was a member of any former group.

(F) Amended statute split-waiver election statement. The term amended statute split-waiver election statement has the meaning provided in paragraph (b)(5)(v)(A) of this section.

(G) Default carryback period. The term default carryback period means the NOL carryback period existing at the time the acquiring group acquired the acquired member, before the applicability of amended carryback rules.

(H) Extended carryback period. The term extended carryback period means the additional taxable years added to a default carryback period by any amended carryback rules.

(I) Extended split-waiver election. The term extended split-waiver election means, with respect to any amended carryback CNOL, an irrevocable election made by an acquiring group to relinquish solely the portion of the extended carryback period (and no part of the default carryback period) for that loss during which an acquired member was a member of any former group.

(J) Extended split-waiver election statement. The term extended split-waiver election statement has the meaning provided in paragraph (b)(5)(v)(B) of this section.

(K) Former group. The term former group means a consolidated group of which an acquired member previously was a member.

(iii) Conditions for making an amended statute split-waiver election or an extended split-waiver election. An acquiring group may make an amended statute split-waiver election or an extended split-waiver election (but not both) with respect to an amended carryback CNOL only if—

(A) The acquiring group has not filed a valid election described in paragraph (b)(4) of this section with respect to the acquired member on or before the effective date of the amended carryback rules;

(B) The acquiring group has not filed a valid election described in section 172(b)(3) and paragraph (b)(3)(i) of this section with respect to a CNOL of the acquiring group from which the amended carryback CNOL is attributed to the acquired member;

(C) Any other corporation joining the acquiring group that was affiliated with the acquired member immediately before the acquired member joined the acquiring group is included in the waiver; and

(D) A former group does not claim any carryback (as provided in paragraph (b)(5)(iv) of this section) to any taxable year in the carryback period (in the case of an amended statute split-waiver election) or in the extended carryback period (in the case of an extended split-waiver election) with respect to the amended carryback CNOL on a return or other filing filed on or before the date the acquiring group files the election.

(iv) Claim for a carryback. For purposes of paragraph (b)(5)(iii)(D) of this section, a carryback is claimed with respect to an amended carryback CNOL if there is a claim for refund, an amended return, an application for a tentative carryback adjustment, or any other filing that claims the benefit of the NOL in a taxable year prior to the taxable year of the loss, whether or not subsequently revoked in favor of a claim based on the period provided for in the amended carryback rules.

(v) Procedures for making an amended statute split-waiver election or an extended split-waiver election—(A) Amended statute split-waiver election. An amended statute split-waiver election must be made in a separate amended statute split-waiver election statement titled “THIS IS AN ELECTION UNDER SECTION 1.1502-21(b)(5)(i) TO WAIVE THE PRE-[insert first day of the first taxable year for which the acquired member was a member of the acquiring group] CARRYBACK PERIOD FOR THE CNOLS ATTRIBUTABLE TO THE [insert taxable year of losses] TAXABLE YEAR(S) OF [insert names and employer identification numbers of members]”. The amended statute split-waiver election statement must be filed as provided in paragraph (b)(5)(vi) of this section.

(B) Extended split-waiver election. An extended split-waiver election must be made in a separate extended split-waiver election statement titled “THIS IS AN ELECTION UNDER SECTION 1.1502-21(b)(5)(i) TO WAIVE THE PRE-[insert first day of the first taxable year for which the acquired member was a member of the acquiring group] EXTENDED CARRYBACK PERIOD FOR THE CNOLS ATTRIBUTABLE TO THE [insert taxable year of losses] TAXABLE YEAR(S) OF [insert names and employer identification numbers of members]”. The extended split-waiver election statement must be filed as provided in paragraph (b)(5)(vi) of this section.

(vi) Time and manner for filing statement—(A) In general. Except as otherwise provided in paragraph (b)(5)(vi)(B) or (C) of this section, an amended statute split-waiver election statement or extended split-waiver election statement must be filed with the acquiring group’s timely filed consolidated return (including extensions) for the year during which the amended carryback CNOL is incurred.

(B) Amended returns. This paragraph (b)(5)(vi)(B) applies if the date of the filing required under paragraph (b)(5)(vi)(A) of this section is not at least 150 days after the date of the statutory amendment to the carryback period referred to in paragraph (b)(5)(ii)(D) of this section. Under this paragraph (b)(5)(vi)(B), an amended statute split-waiver election statement or extended split-waiver election statement may be attached to an amended return filed by the date that is 150 days after the date of the statutory amendment referred to in paragraph (b)(5)(ii)(D) of this section.

(C) Certain taxable years beginning before January 1, 2021. This paragraph (b)(5)(vi)(C) applies to taxable years beginning before January 1, 2021, for which the date of the filing required under paragraph (b)(5)(vi)(A) of this section precedes November 30, 2020. Under this paragraph (b)(5)(vi)(C), an amended statute split-waiver election statement or extended split-waiver election statement may be attached to an amended return filed by November 30, 2020.

(6) Examples. The following examples illustrate the rules of paragraph (b)(5) of this section. For purposes of these examples: All affiliated groups file consolidated returns; all corporations are includible corporations that have calendar taxable years; each of P, X, and T is a corporation having one class of stock outstanding; each of P and X is the common parent of a consolidated group (P Group and X Group, respectively); neither the P Group nor the X Group includes an insolvent financial institution or an insurance company; no NOL is a farming loss; there are no other relevant NOL carrybacks to the X Group’s consolidated taxable years; except as otherwise stated, the X Group has sufficient consolidated taxable income determined under §1.1502-11 (CTI) to absorb the stated NOL carryback by T; T has sufficient SRLY register income within the X Group to absorb the stated NOL carryback by T; all transactions occur between unrelated parties; and the facts set forth the only relevant transactions.

(i) Example 1: Computation and absorption of amended carrybacks—(A) Facts. In Year 1, T became a member of the X Group. On the last day of Year 5, P acquired all the stock of T from X. At the time of P’s acquisition of T stock, the default carryback period was zero taxable years. The P Group did not make an irrevocable split-waiver election under paragraph (b)(4) of this section to relinquish, with respect to all CNOLs attributable to T while a member of the P Group, the portion of the carryback period for which T was a member of the X Group (that is, a former group). In Year 7, the P Group sustained a $1,000 CNOL, $600 of which was attributable to T pursuant to paragraph (b)(2)(iv)(B) of this section. In that year, P did not make an irrevocable general waiver election under section 172(b)(3) and paragraph (b)(3)(i) of this section with respect to the $1,000 CNOL when the P Group filed its consolidated return for Year 7. In Year 8, legislation was enacted that amended section 172 to require a carryback period of five years for NOLs arising in a taxable year beginning after Year 5 and before Year 9.

(B) Analysis. As a result of the amended carryback rules enacted in Year 8, the P Group’s $1,000 CNOL in Year 7 must be carried back to Year 2. Therefore, T’s $600 attributed portion of the P Group’s Year 7 CNOL (that is, T’s amended carryback CNOL) must be carried back to taxable years of the X Group. See paragraphs (b)(1) and (b)(2)(i) of this section. To the extent T’s amended carryback CNOL is not absorbed in the X Group’s Year 2 taxable year, the remaining portion must be carried to the X Group’s Year 3, Year 4, and Year 5 taxable years, as appropriate. See id. Any remaining portion of T’s amended carryback CNOL is carried to consolidated return years of the P Group. See paragraph (b)(1) of this section.

(ii) Example 2: Amended statute split-waiver election—(A) Facts. The facts are the same as in paragraph (b)(6)(i)(A) of this section (Example 1), except that, following the change in statutory carryback period in Year 8, the P Group made a valid amended statute split-waiver election under paragraph (b)(5)(i) of this section to relinquish solely the carryback of T’s amended carryback CNOL.

(B) Analysis. Because the P Group made a valid amended statute split-waiver election, T’s amended carryback CNOL is not eligible to be carried back to any taxable years of the X Group (that is, a former group). However, the amended statute split-waiver election does not prevent T’s Year 7 amended carryback CNOL from being carried back to years of the P group (that is, the acquiring group) during which T was a member. See paragraph (b)(5)(ii)(E) of this section. As a result, the entire amount of T’s amended carryback CNOL is eligible to be carried back to taxable Year 6 of the P Group. Any remaining CNOL may then be carried over within the P Group. See paragraph (b)(1) of this section.

(iii) Example 3: Computation and absorption of extended carrybacks—(A) Facts. The facts are the same as in paragraph (b)(6)(i)(A) of this section (Example 1), except that the X Group had $300 of CTI in Year 4 and $200 of CTI in Year 5 and, at the time of the P Group’s acquisition of T, the default carryback period was two years. Therefore, T’s $600 attributed portion of the P Group’s Year 7 CNOL was required to be carried back to the X Group’s Year 5 taxable year, and the X Group was able to offset $200 of CTI in Year 5.

(B) Analysis. As a result of the amended carryback rules, the X Group must offset its $300 of CTI in Year 4 against T’s amended carryback CNOL. See paragraphs (b)(1) and (b)(2)(i) of this section. The remaining $100 ($600-$300-$200) of T’s amended carryback CNOL is carried to taxable years of the P Group. See paragraph (b)(1) of this section.

(iv) Example 4: Extended split-waiver election—(A) Facts. The facts are the same as in paragraph (b)(6)(iii)(A) of this section (Example 3), except that, following the change in law in Year 8, the P Group made a valid extended split-waiver election under paragraph (b)(5)(i) of this section to relinquish the extended carryback period for T’s amended carryback CNOL for years in which T was a member of the X Group.

(B) Analysis. As a result of the P Group’s extended split-waiver election, T’s amended carryback CNOL is not eligible to be carried back to any portion of the extended carryback period (that is, any taxable year prior to Year 5). See paragraph (b)(5)(ii)(I) of this section. As a result, the X Group absorbs $200 of T’s $600 loss in Year 5, and the remaining $400 ($600-$200) is carried to taxable years of the P Group. See paragraph (b)(1) of this section.

(7) Short years in connection with transactions to which section 381(a) applies. If a member distributes or transfers assets to a corporation that is a member immediately after the distribution or transfer in a transaction to which section 381(a) applies, the transaction does not cause the distributor or transferor to have a short year within the consolidated return year of the group in which the transaction occurred that is counted as a separate year for purposes of determining the years to which a net operating loss may be carried.

* * * * *

(h) * * *

(9) Amended carryback rules. Paragraphs (b)(5) and (6) of this section apply to any CNOLs arising in a taxable year ending after July 2, 2020. However, taxpayers may apply paragraphs (b)(5) and (6) of this section to any CNOLs arising in a taxable year beginning after December 31, 2017.

* * * * *

§1.1502-21T [Removed]

Par. 3. Section 1.1502-21T is removed.

§1.1502-78 [Amended]

Par. 4. Section 1.1502-78 is amended by removing the language “§1.1502-21(b)(3)(ii)(B)” in paragraph (a) and adding the language “§1.1502-21(b)(4)” in its place.

PART 602—OMB CONTROL NUMBERS UNDER THE PAPERWORK REDUCTION ACT

Par. 5. The authority citation for part 602 continues to read as follows:

Authority: 26 U.S.C. 7805.

Par. 6. In §602.101, amend the table in paragraph (b) by:

a. Revising the entry for “§1.1502-21”; and

b. Removing the entry for “§1.1502.21T”.

The revision reads as follows:

§602.101 OMB Control Numbers.

* * * * *

(b) * * *

| CFR part or section where identified and described | Current OMB control No. |

|---|---|

| * * * * * * * | |

| 1.1502-21 . . . . . . . . . . . . . . . . . . . . . . . . | 1545-0123 |

| * * * * * * * | |

Douglas W. O’Donnell,

Deputy Commissioner for Services and Enforcement.

Approved: June 21, 2023.

Lily Batchelder,

Assistant Secretary of the Treasury (Tax Policy).

(Filed by the Office of the Federal Register July 10, 2023, 4:15 p.m., and published in the issue of the Federal Register for July 12, 2023, 88 FR 44210)

This notice provides transition relief for plan administrators, payors, plan participants, IRA owners, and beneficiaries in connection with the change in the required beginning date for required minimum distributions (RMDs) under § 401(a)(9) of the Internal Revenue Code (Code) pursuant to §107 of the SECURE 2.0 Act of 2022 (SECURE 2.0 Act), enacted on December 29, 2022, as Division T of the Consolidated Appropriations Act, 2023, Pub. L. 117-328, 136 Stat. 4459 (2022). This notice also provides guidance related to certain specified RMDs for 2023. In addition, this notice announces that the final regulations that the Department of the Treasury (Treasury Department) and the Internal Revenue Service (IRS) intend to issue related to RMDs will apply for purposes of determining RMDs for calendar years beginning no earlier than 2024.

Section 401(a)(9) of the Code requires a stock bonus, pension, or profit-sharing plan described in § 401(a) (or an annuity contract described in § 403(a)) to make minimum distributions starting by the required beginning date (as well as minimum distributions to beneficiaries if the employee dies before the required beginning date). Individual retirement accounts and individual retirement annuities (IRAs) described in § 408(a) and (b), annuity contracts, custodial accounts, and retirement income accounts described in §403(b) (§ 403(b) plans), and eligible deferred compensation plans under § 457(b), are also subject to the rules of § 401(a)(9) pursuant to §§ 408(a)(6) and (b)(3), 403(b)(10), and 457(d)(2), respectively, and the regulations under those sections.

Section 107 of the SECURE 2.0 Act amended § 401(a)(9) of the Code to change the required beginning date applicable to § 401(a) plans and other eligible retirement plans, including IRAs. Rather than defining the required beginning date by reference to April 1 of the calendar year following the calendar year in which an individual attains age 72, the new required beginning date for an employee or IRA owner is defined by reference to April 1 of the calendar year after the calendar year in which the individual attains the applicable age (which is either age 73 or age 75, depending on the individual’s date of birth). Thus, for example, an IRA owner who was born in 1951 will have a required beginning date of April 1, 2025, rather than April 1, 2024, (and the first distribution made to that IRA owner that will be treated as an RMD will be a distribution made for 2024, rather than 2023).

Section 401(a)(9) provides rules for RMDs from a qualified plan during the life of the employee in § 401(a)(9)(A) and after the death of the employee in § 401(a)(9)(B). In addition to setting forth a required beginning date for distributions, these rules identify the period over which the employee’s entire interest must be distributed.

Specifically, § 401(a)(9)(A)(ii) provides that the entire interest of an employee in a qualified plan must be distributed, beginning not later than the employee’s required beginning date, in accordance with regulations, over the life of the employee or over the lives of the employee and a designated beneficiary (or over a period not extending beyond the life expectancy of the employee and a designated beneficiary).

Section 401(a)(9)(B)(i) provides that, if the employee dies after distributions have begun, the employee’s remaining interest must be distributed at least as rapidly as under the method of distributions being used by the employee under section 401(a)(9)(A)(ii) as of the date of the employee’s death. Section 401(a)(9)(B)(ii) and (iii) provides that, if the employee dies before RMDs have begun, the employee’s interest must either be: (1) distributed within 5 years after the death of the employee (5-year rule), or (2) distributed (in accordance with regulations) over the life or life expectancy of the designated beneficiary with the distributions beginning no later than 1 year after the date of the employee’s death (subject to an exception in § 401(a)(9)(B)(iv) if the designated beneficiary is the employee’s surviving spouse).

The rules of § 401(a)(9) are incorporated by reference in § 408(a)(6) and (b)(3) for IRAs, § 403(b)(10) for § 403(b) plans), and § 457(d) for eligible deferred compensation plans.

1. Ten-year rule

Section 401(a)(9) of the Code was amended by § 401(a)(1) of the Setting Every Community Up for Retirement Enhancement Act of 2019 (SECURE Act), enacted on December 20, 2019, as Division O of the Further Consolidated Appropriations Act, 2020, Pub. L. 116-94, 133 Stat. 2534 (2019), to add § 401(a)(9)(H) to the Code. Generally, pursuant to § 401(a)(9)(H)(i), if an employee in a defined contribution plan has a designated beneficiary, the 5-year period under the 5-year rule is lengthened to 10 years (10-year rule) and the 10-year rule applies regardless of whether the employee dies before the required beginning date. In addition, pursuant to § 401(a)(9)(H)(ii), the § 401(a)(9)(B)(iii) exception to the 10-year rule (under which the 10-year rule is treated as satisfied if distributions are paid over the designated beneficiary’s lifetime or life expectancy) applies only if the designated beneficiary is an eligible designated beneficiary, as that term is defined in § 401(a)(9)(E)(ii).

Section 401(a)(9)(H)(iii) provides that when an eligible designated beneficiary dies before that individual’s portion of the employee’s interest in the plan has been entirely distributed, the beneficiary of the eligible designated beneficiary will be subject to a requirement that the remainder of that individual’s portion be distributed within 10 years of the eligible designated beneficiary’s death. In addition, § 401(a)(9)(E)(iii) provides that when an eligible designated beneficiary who is a minor child of the employee reaches the age of majority, that child will no longer be considered an eligible designated beneficiary and the remainder of that child’s portion of the employee’s interest in the plan must be distributed within 10 years of that date.

2. Section 401(a)(9)(H) effective date

Section 401(b)(1) of the SECURE Act provides that, generally, the amendments made to § 401(a)(9)(H) of the Code apply to distributions with respect to employees who die after December 31, 2019. Pursuant to § 401(b)(2) and (3) of the SECURE Act, later effective dates apply for certain collectively bargained plans and governmental plans (as defined in § 414(d) of the Code).

Section 401(b)(4) of the SECURE Act provides that § 401(a)(9)(H) of the Code does not apply to payments under certain annuity contracts under which payment commenced (or the manner of payments was fixed) before December 20, 2019. Section 401(b)(5) of the SECURE Act provides that if an employee who participated in a plan died before § 401(a)(9)(H) of the Code became effective with respect to the plan, and the employee’s designated beneficiary died after that effective date, then that designated beneficiary is treated as an eligible designated beneficiary and § 401(a)(9)(H) applies to any beneficiary of that designated beneficiary.

Section 4974(a) provides that if the amount distributed during a year to a payee under any qualified retirement plan (as defined in § 4974(c)) or any eligible deferred compensation plan (as defined in § 457(b)) is less than that year’s minimum required distribution (as defined in § 4974(b)), then an excise tax is imposed on the payee. Pursuant to § 302 of the SECURE 2.0 Act, for taxable years beginning after December 29, 2022, this excise tax is equal to 25 percent of the amount by which the minimum required distribution for a year exceeds the amount actually distributed in that year. If a failure to take a minimum required distribution is corrected by the end of the correction window (generally, the end of the second year that begins after the year of the missed minimum required distribution), the excise tax is reduced from 25 percent to 10 percent.

The Treasury Department and the IRS published proposed regulations regarding RMDs under § 401(a)(9) of the Code and related provisions in the Federal Register on February 24, 2022 (87 FR 10504), which provided that the regulations, when finalized, would apply beginning with the 2022 calendar year. Along with other matters, the proposed regulations address issues relating to the 10-year rule in § 401(a)(9)(H). Specifically, Prop. Reg. § 1.401(a)(9)-5(d)(1)(i) requires that, in the case of an employee who dies on or after the employee’s required beginning date, distributions to the employee’s beneficiaries for calendar years after the calendar year of the employee’s death must satisfy § 401(a)(9)(B)(i). In addition, distributions to the employee’s beneficiaries must also satisfy § 401(a)(9)(B)(ii) (or if applicable, § 401(a)(9)(B)(iii)), taking into account § 401(a)(9)(E)(iii), (H)(ii), and (H)(iii).

In order to satisfy § 401(a)(9)(B)(i), the beneficiary of an employee who died after the employee’s required beginning date must take an annual RMD beginning in the first calendar year after the calendar year of the employee’s death. In order to satisfy § 401(a)(9)(B)(ii) (applied by substituting “10 years” for “5 years”), the remaining account balance must be distributed by the 10th calendar year after the calendar year of the employee’s death (subject to an exception under § 401(a)(9)(B)(iii), if applicable). In order to satisfy both of those requirements, the proposed regulations generally provide that, in the case of an employee who dies after the employee’s required beginning date with a designated beneficiary who is not an eligible designated beneficiary (and for whom the § 401(a)(9)(B)(iii) alternative to the 10-year rule is not applicable), annual RMDs must continue to be taken after the death of the employee, with a full distribution required by the end of the 10th calendar year following the calendar year of the employee’s death.

In the case of a designated beneficiary who is an eligible designated beneficiary, the proposed regulations include an alternative to the 10-year rule under which annual lifetime or life expectancy payments would be made to the beneficiary beginning in the year following the year of the employee’s death, in accordance with § 401(a)(9)(B)(iii). Under the proposed regulations, if an eligible designated beneficiary of an employee is using the lifetime or life expectancy payment alternative to the 10-year rule, then the eligible designated beneficiary (and, after the death of the eligible designated beneficiary, the beneficiary of the eligible designated beneficiary) would need to continue to take annual RMDs after the death of the employee (with the employee’s entire interest distributed by no later than the 10th year after the year of the eligible designated beneficiary’s death). The proposed regulations provide for similar treatment (that is, continued annual RMDs with a requirement that the employee’s entire interest be distributed no later than the 10th year after a specified event) in the case of a designated beneficiary who is a minor child of the employee (with the specified event being the child’s reaching the age of majority).

The Treasury Department and the IRS provided a 90-day comment period for the proposed regulations. Some individuals who are owners of inherited IRAs or are beneficiaries under defined contribution plans submitted comments indicating that they thought the new 10-year rule would apply differently than it would under the proposed regulations. Specifically, these commenters expected that, regardless of when an employee died, the 10-year rule would operate like the 5-year rule, such that there would not be any RMD due for a calendar year until the last year of the 5- or 10-year period following the specified event (the death of the employee, the death of the eligible designated beneficiary, or the attainment of the age of majority for the employee’s child who is an eligible designated beneficiary). Commenters who are heirs or beneficiaries of individuals who died in 2020 explained that they did not take an RMD in 2021 and were unsure of whether they would be required to take an RMD in 2022. Commenters asserted that, if final regulations adopt the interpretation of the 10-year rule set forth in the proposed regulations, the Treasury Department and the IRS should provide transition relief for failure to take distributions that are RMDs due in 2021 or 2022 pursuant to § 401(a)(9)(H) in the case of the death of an employee (or designated beneficiary) in 2020 or 2021.

In response to the comments received on the proposed regulations, the Treasury Department and the IRS issued Notice 2022-53, 2022-45 IRB 437. Notice 2022-53 announced that the final regulations will apply no earlier than the 2023 distribution calendar year and provided guidance regarding certain amounts that were not paid in 2021 or 2022. Specifically, Notice 2022-53 provided that a defined contribution plan will not fail to be qualified for failing to make a specified RMD (as defined in that notice) in 2021 or 2022 and the taxpayer who did not take a specified RMD will not be subject to the excise tax under § 4974 for failing to take the specified RMD.

Section 402(c) generally provides that the payment of any portion of an employee’s interest in a qualified trust to the employee or the employee’s surviving spouse in an eligible rollover distribution is not includible in gross income if the distribution is rolled over to an eligible retirement plan described in § 402(c)(8) no later than the 60th day following the day of receipt. An eligible rollover distribution is defined in § 402(c)(4) as a distribution to an employee of all or any portion of the balance to the credit of the employee in a qualified trust other than a distribution that is: (A) one of a series of substantially equal periodic payments made over a specified period; (B) a distribution required under § 401(a)(9)1; or (C) a distribution made on account of the employee’s hardship. Section 402(c)(3)(B) provides that the Secretary may waive the 60-day rollover deadline under certain circumstances. Section 402(c)(11) provides for the direct rollover of a deceased employee’s interest in a qualified trust to an inherited IRA established for the deceased employee’s nonspouse designated beneficiary.

Section 401(a)(31) provides that a trust does not constitute a qualified trust unless the plan of which the trust is a part provides that, if the distributee of any eligible rollover distribution elects to have the distribution paid directly to an eligible retirement plan and specifies the eligible retirement plan to which the distribution is to be paid, the distribution will be made in the form of a direct trustee-to-trustee transfer. Within a reasonable period of time prior to making an eligible rollover distribution, the plan administrator of a plan qualified under § 401(a) is required to provide to the recipient the written explanation described in § 402(f)(1).

Rules similar to those described in the preceding two paragraphs apply to § 403(a) annuity plans, § 403(b) plans, and § 457 eligible governmental plans. See §§ 403(a)(4) and (5), 403(b)(8) and (10), and 457(d)(1)(C) and (e)(16).

If the recipient of an eligible rollover distribution does not elect in accordance with § 401(a)(31) to have the distribution paid directly to an eligible retirement plan described in § 402(c)(8), then under § 3405(c), the payor of the distribution is required to withhold from the distribution an amount equal to 20 percent of the distribution.

Section 408(d)(3) generally provides that an amount distributed from an IRA to the IRA owner, or to the surviving spouse of the IRA owner, is not included in gross income if the distribution is rolled over to an eligible retirement plan no later than the 60th day following the day of receipt. A distribution of an after-tax amount may only be rolled over to another IRA. Section 408(d)(3)(B) provides that an IRA owner may roll over only one IRA distribution in a 12-month period, and § 408(d)(3)(E) provides that an RMD may not be rolled over. Section 408(d)(3)(I) provides that the Secretary may waive the 60-day rollover deadline under certain circumstances.

Final regulations regarding RMDs under § 401(a)(9) and related provisions will apply for calendar years beginning no earlier than 2024.

Following enactment of the SECURE 2.0 Act, plan administrators and other payors indicated that automated payment systems would need to be updated to reflect the change in the required beginning date under § 401(a)(9)(C) pursuant to § 107 of the SECURE 2.0 Act. They expressed concern that these revisions could take some time to implement and, as a result, plan participants and IRA owners who would have been required to begin receiving RMDs for calendar year 2023 but for § 107 of the SECURE 2.0 Act (i.e., those who will attain age 72 in 2023) and who receive distributions in 2023 could have had those distributions mischaracterized as RMDs (and therefore ineligible for rollover). This Section IV grants certain relief relating to certain distributions made during 2023 to individuals that were characterized as RMDs but are not actually RMDs as a result of the enactment of § 107 of the SECURE 2.0 Act.

A. Payor and plan administrator guidance related to SECURE 2.0 Act change to required beginning date. A payor or plan administrator will not be considered to have failed to satisfy the requirements of §§ 401(a)(31), 402(f), and 3405(c) merely because of a failure to treat certain distributions as eligible rollover distributions. This relief applies with respect to any distribution made from a plan between January 1, 2023, and July 31, 2023, to a participant born in 1951 (or that participant’s surviving spouse) that would have been an RMD but for the change in the required beginning date under § 107 of the SECURE 2.0 Act.

B. Extension of 60-day deadline for rollover of certain distributions. Pursuant to § 402(c)(3)(B), the Treasury Department and the IRS are extending the 60-day rollover period for any distribution described in section IV.A of this notice so that the deadline for rolling over such a distribution will be September 30, 2023. For example, if a participant who was born in 1951 received a single-sum distribution in January 2023, part of which was treated as ineligible for rollover because it was mischaracterized as an RMD, that participant will have until September 30, 2023, to roll over that mischaracterized part of the distribution.

C. Relief relating to RMDs previously distributed from an IRA. Pursuant to § 408(d)(3)(I), the Treasury Department and the IRS are extending the 60-day rollover period for certain IRA distributions made to an IRA owner (or the IRA owner’s surviving spouse), so that the deadline for rolling over that portion of the distribution will be September 30, 2023. The distributions that are subject to this extension are distributions made from an IRA between January 1, 2023, and July 31, 2023, to an IRA owner born in 1951 (or that individual’s surviving spouse) that would have been RMDs but for the change in the required beginning date under § 107 of the SECURE 2.0 Act. This rollover is permitted even if the IRA owner or surviving spouse has rolled over a distribution within the last twelve months. However, making such a rollover of the portion of an IRA distribution mischaracterized as an RMD will preclude the IRA owner or surviving spouse from rolling over a distribution in the next twelve months. In that case, that individual could still make a direct trustee-to-trustee transfer as described in Rev. Rul. 78-406, 1978-2 CB 157.

A. Guidance for defined contribution plans that did not make a specified RMD. A defined contribution plan that failed to make a specified RMD (as defined in section V.C of this notice) will not be treated as having failed to satisfy § 401(a)(9) merely because it did not make that distribution.

B. Guidance for certain taxpayers who did not take a specified RMD. To the extent a taxpayer did not take a specified RMD (as defined in section V.C of this notice), the IRS will not assert that an excise tax is due under § 4974.

C. Definition of specified RMD. For purposes of this notice, a specified RMD is any distribution that, under the interpretation included in the proposed regulations, would be required to be made pursuant to § 401(a)(9) in 2023 under a defined contribution plan or IRA that is subject to the rules of § 401(a)(9)(H) for the year in which the employee (or designated beneficiary) died if that payment would be required to be made to:

-

a designated beneficiary of an employee under the plan (or IRA owner) if: (1) the employee (or IRA owner) died in 2020, 2021, or 2022, and on or after the employee’s (or IRA owner’s) required beginning date, and (2) the designated beneficiary is not using the lifetime or life expectancy payments exception under § 401(a)(9)(B)(iii); or

-

a beneficiary of an eligible designated beneficiary (including a designated beneficiary who is treated as an eligible designated beneficiary pursuant to § 401(b)(5) of the SECURE Act) if: (1) the eligible designated beneficiary died in 2020, 2021, or 2022, and (2) that eligible designated beneficiary was using the lifetime or life expectancy payments exception under § 401(a)(9)(B)(iii) of the Code.

The principal author of this notice is Jessica Weinberger of the Office of Associate Chief Counsel (Employee Benefits, Exempt Organizations, and Employment Taxes). For further information regarding this notice, contact Jessica Weinberger at (202) 317-6349 (not a toll-free number).

NOTE. This revenue procedure will be reproduced as the next revision of IRS Publication 1141, General Rules and Specifications for Substitute Forms W-2 and W-3.

1 Under § 1.402(c)-2, in determining which amounts are treated as eligible rollover distributions, if a minimum distribution is required for a calendar year, the amounts distributed during that calendar year are treated as RMDs to the extent that the total RMD under § 401(a)(9) for the calendar year has not been satisfied.

| Part 1 – GENERAL | |

|---|---|

| Section 1.1 – Purpose | 387 |

| Section 1.2 – What’s New | 389 |

| Section 1.3 – General Rules for Paper Forms W-2 and W-3 | 389 |

| Section 1.4 – General Rules for Filing Forms W-2 (Copy A) Electronically | 391 |

| Part 2 – SPECIFICATIONS FOR SUBSTITUTE FORMS W-2 AND W-3 | |

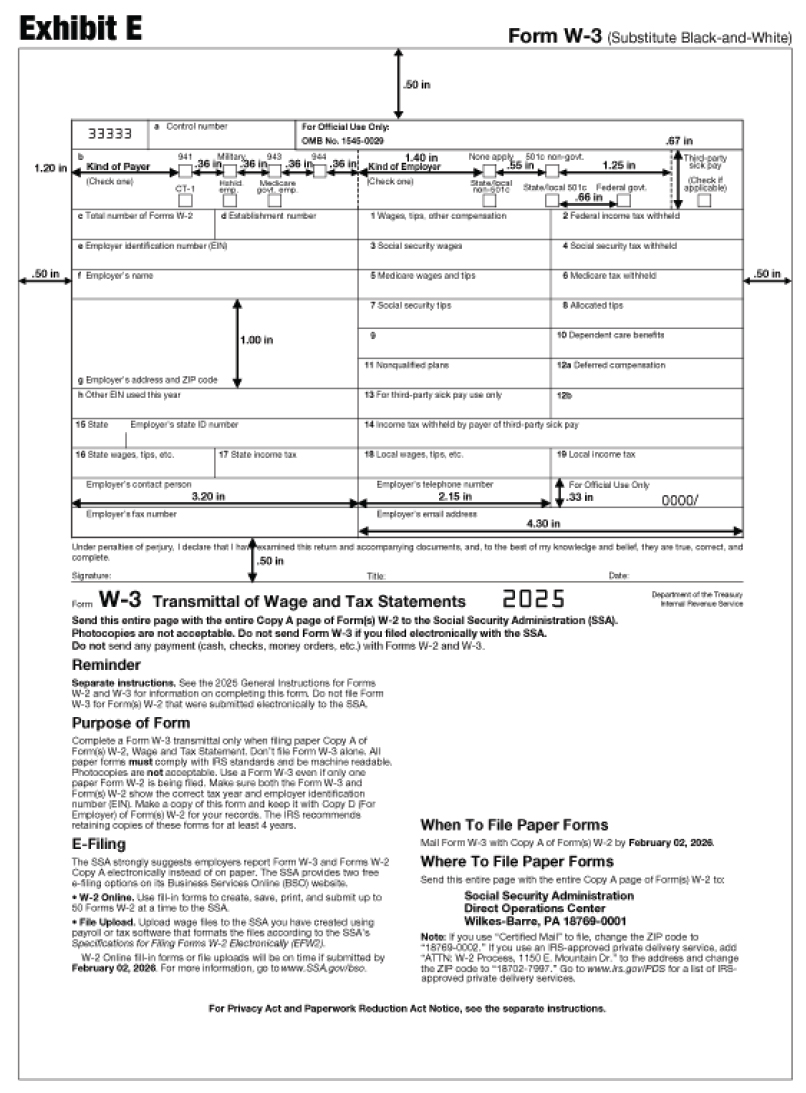

| Section 2.1 – Specifications for Red-Ink Substitute Form W-2 (Copy A) and Form W-3 Filed With the SSA | 392 |

| Section 2.2 – Specifications for Substitute Black-and-White Form W-2 (Copy A) and Form W-3 Filed With the SSA | 394 |

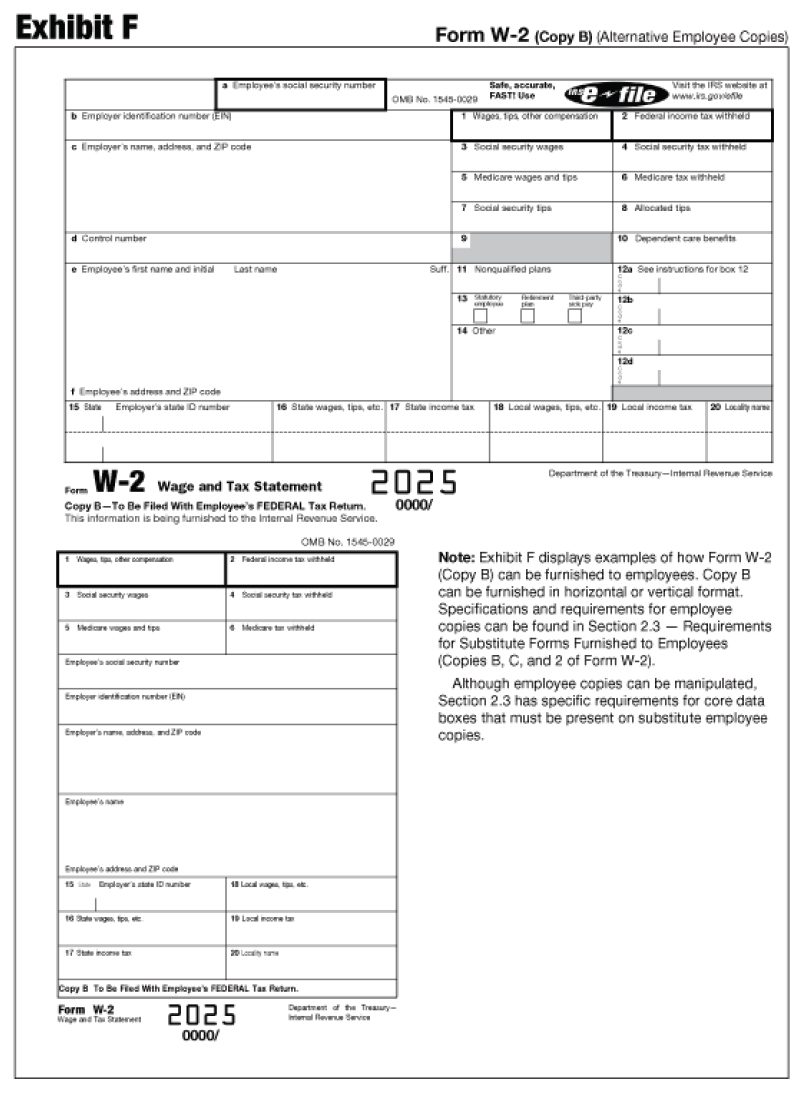

| Section 2.3 – Requirements for Substitute Forms Furnished to Employees (Copies B, C, and 2 of Form W-2) | 397 |

| Section 2.4 – Electronic Delivery of Forms W-2 and W-2c Recipient Statements | 400 |

| Part 3 – ADDITIONAL INSTRUCTIONS | |

| Section 3.1 – Additional Instructions for Form Printers | 402 |

| Section 3.2 – Instructions for Employers | 402 |

| Section 3.3 – OMB Requirements for Both Red-Ink and Black-and-White Substitute Forms W-2 and W-3 | 403 |

| Section 3.4 – Order Forms and Instructions | 404 |

| Section 3.5 – Effect on Other Documents | 404 |

| Section 3.6 – Exhibits | 404 |

.01 The purpose of this revenue procedure is to state the requirements of the Internal Revenue Service (IRS) and the Social Security Administration (SSA) regarding the preparation and use of substitute forms for Form W-2, Wage and Tax Statement, and Form W-3, Transmittal of Wage and Tax Statements, for wages paid during the 2023 calendar year.

.02 For purposes of this revenue procedure, substitute Form W-2 (Copy A) and substitute Form W-3 are forms that are not printed by the IRS. Copy A or any other copies of a substitute Form W-2 or a substitute Form W-3 must conform to the specifications in this revenue procedure to be acceptable to the IRS and the SSA. No IRS office is authorized to allow deviations from this revenue procedure. Preparers should also refer to the 2023 General Instructions for Forms W-2 and W-3 for details on how to complete these forms. See Section 3.4, later, for information on obtaining the official IRS forms and instructions. See Sections 2.3 and 2.4, later, for requirements for the copies of substitute forms furnished to employees and for electronic delivery of employee copies.

.03 For purposes of this revenue procedure, the official IRS-printed red dropout ink Forms W-2 (Copy A) and Form W-3, and their exact substitutes, are referred to as “red-ink.” The SSA-approved black-and-white Forms W-2 (Copy A) and Form W-3 are referred to as “substitute black-and-white Forms W-2 (Copy A)” and “substitute black-and-white Form W-3,” respectively. Any questions about the red-ink Form W-2 (Copy A) and Form W-3 and the substitute employee statements should be emailed to substituteforms@irs.gov. Please enter “Substitute Forms” on the subject line. Or send your questions to:

Internal Revenue Service

Attn: Substitute Forms Program

SE:W:CAR:MP:P:TP:TP

NCFB

5000 Ellin Road

Mail Stop C6-175

Lanham, MD 20706

Note. Do not send completed forms to the Substitute Forms Program via email or mail as they are unable to process those forms. Any examples/samples of substitute forms sent to the Substitute Forms Program should not contain taxpayer information.

Any questions about the black-and-white Form W-2 (Copy A) and Form W-3 should be emailed to copy.a.forms@ssa.gov or sent to:

Social Security Administration

Direct Operations Center

Attn: Substitute Black-and-White Copy A Forms, Room 341

1150 E. Mountain Drive

Wilkes-Barre, PA 18702-7997

Note. You should receive a response from either the IRS or the SSA within 30 days.

.04 Some Forms W-2 that include logos, slogans, and advertisements (including advertisements for tax preparation software) may be considered as suspicious or altered Forms W-2 (also known as questionable Forms W-2). An employee may not recognize the importance of the employee copy for tax reporting purposes due to the use of logos, slogans, and advertisements. Thus, the IRS has determined that logos, slogans, and advertising will not be allowed on Copy A of Forms W-2, Forms W-3, or any employee copies reporting wages, with the following exceptions for the employee copies.

-

Forms may include the exact name of the employer or agent, primary trade name, trademark, service mark, or symbol of the employer or agent.

-

Forms may include an embossment or watermark on the information return (and copies) that is a representation of the name, a primary trade name, trademark, service mark, or symbol of the employer or agent.

-

Presentation may be in any typeface, font, stylized fashion, or print color normally used by the employer or agent, and used in a nonintrusive manner.

-

These items must not materially interfere with the ability of the recipient to recognize, understand, and use the tax information on the employee copies.

The IRS e-file logo on the IRS official employee copies may be included, but it is not required, on any of the substitute form copies.

The information return and employee copies must clearly identify the employer’s name associated with its employer identification number (EIN).

Logos and slogans may be used on permissible enclosures, such as a check or account statement, but not on information returns and employee copies.

Forms W-2 and W-3 are subject to annual review and possible change. This revenue procedure may be revised to state other requirements of the IRS and the SSA regarding the preparation and use of substitute forms for Form W-2 and Form W-3 for wages paid during the 2023 calendar year at a future date. If you have comments about the restrictions on including logos, slogans, and advertising on information returns and employee copies, send or email your comments to: Internal Revenue Service, Attn: Substitute Forms Program, SE:W:CAR:MP:P:TP:TP, NCFB, 5000 Ellin Road, Mail Stop C6-175, Lanham, MD 20706, or substituteforms@irs.gov.

.05 The Internal Revenue Service/Information Returns Branch (IRS/IRB) maintains a centralized customer service call site to answer questions related to information returns (Forms W-2, W-3, W-2c, W-3c, 1099 series, 1096, etc.). You can reach the call site at 866-455-7438 (toll free) or 304-263-8700 (not a toll-free number). Deaf or hard-of-hearing customers may call any of our toll-free numbers using their choice of relay service. You may also email questions to mccirp@irs.gov. Do not submit employee information via email because it is not secure and the information may be compromised.

File paper or electronic Forms W-2 (Copy A) with the SSA. The IRS/IRB does not process Forms W-2 (Copy A). However, the IRS/IRB does process Form 8508, Application for a Waiver from Electronic Filing of Information Returns, and Form 8809, Application for Extension of Time To File Information Returns, for Forms W-2 (Copy A) and requests for an extension of time to furnish the employee copies of Form W-2. See Publication 1220, Specifications for Electronic Filing of Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G, for information on waivers and extensions of time. See Regulations section 301.6011-2 for information on when you are required to file electronically and the exclusions from the electronic filing requirements.

.06 The following form instructions and publications provide more detailed filing procedures for certain information returns.

-

General Instructions for Forms W-2 and W-3 (Including Forms W-2AS, W-2CM, W-2GU, W-2VI, W-3SS, W-2c, and W-3c).

-

Publication 1223, General Rules and Specifications for Substitute Forms W-2c and W-3c.

.01 Electronic filing of returns. The Department of the Treasury and the IRS issued final regulations (T.D. 9972) that reduce the threshold for mandatory electronic filing from 250 non-aggregate returns to 10 aggregate returns as authorized under the Taxpayer First Act, enacted July 1, 2019. If you file 10 or more information returns, you must file electronically. See Regulations section 301.6011-2 for more information, including exclusions from the electronic filing requirements.

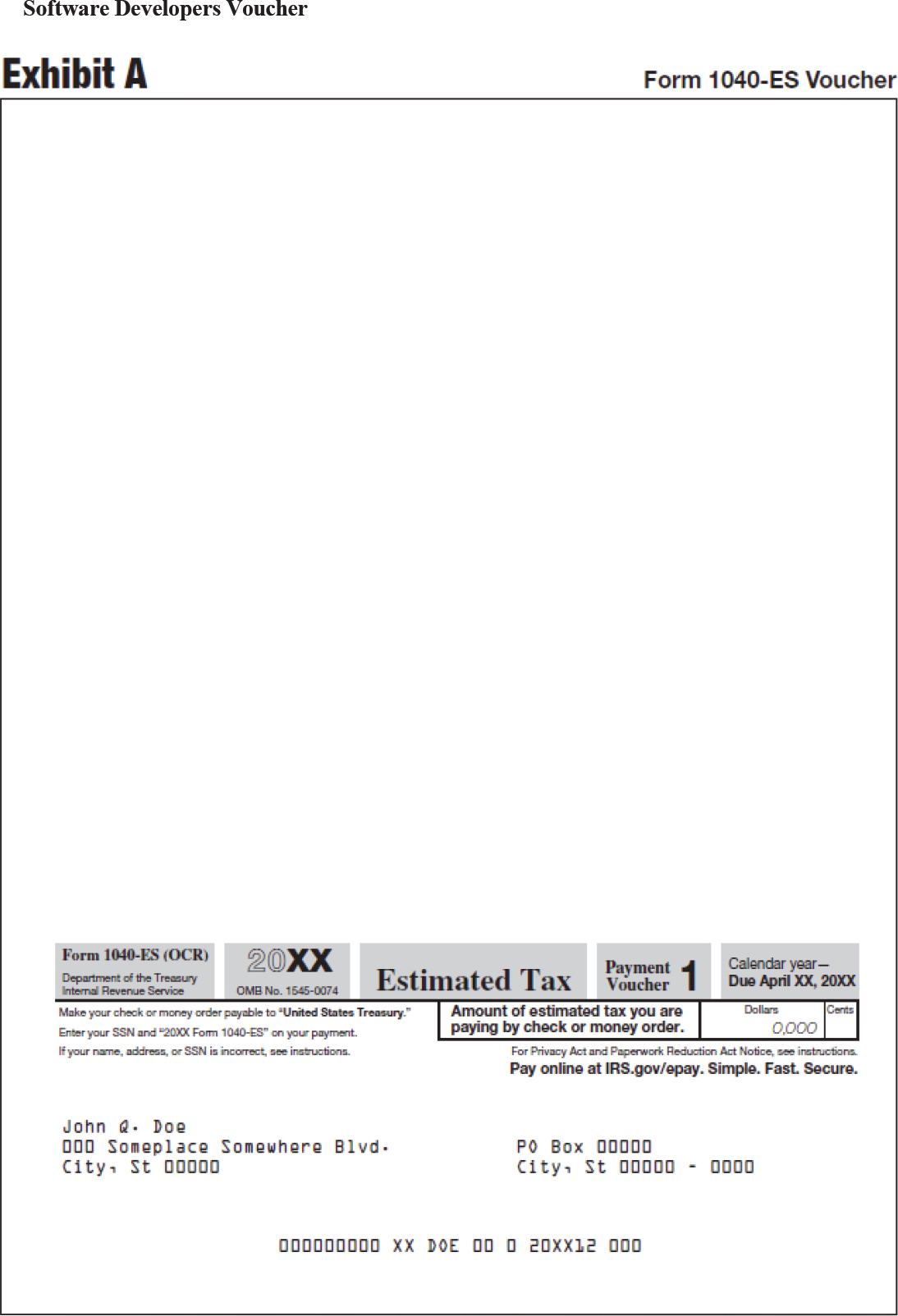

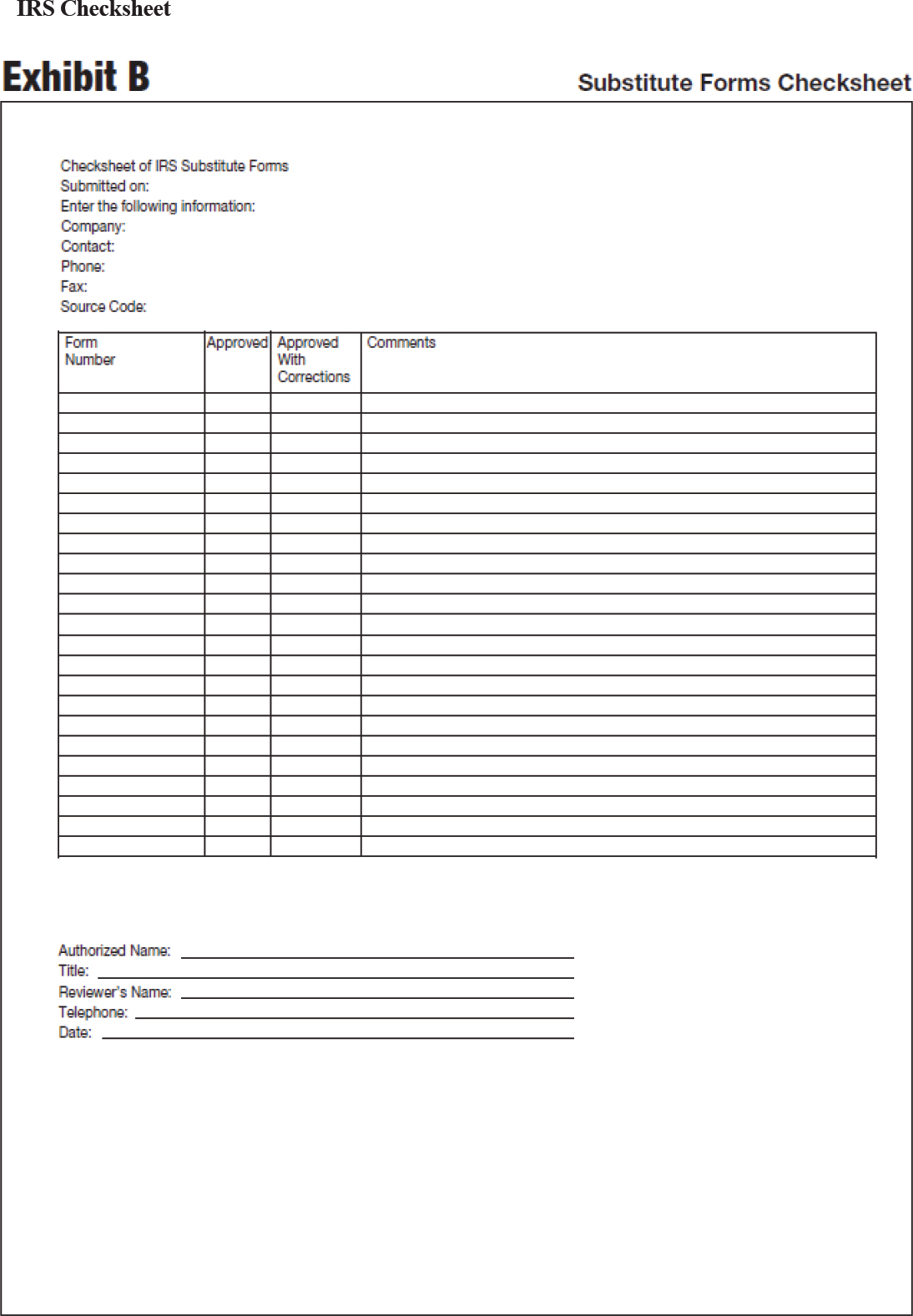

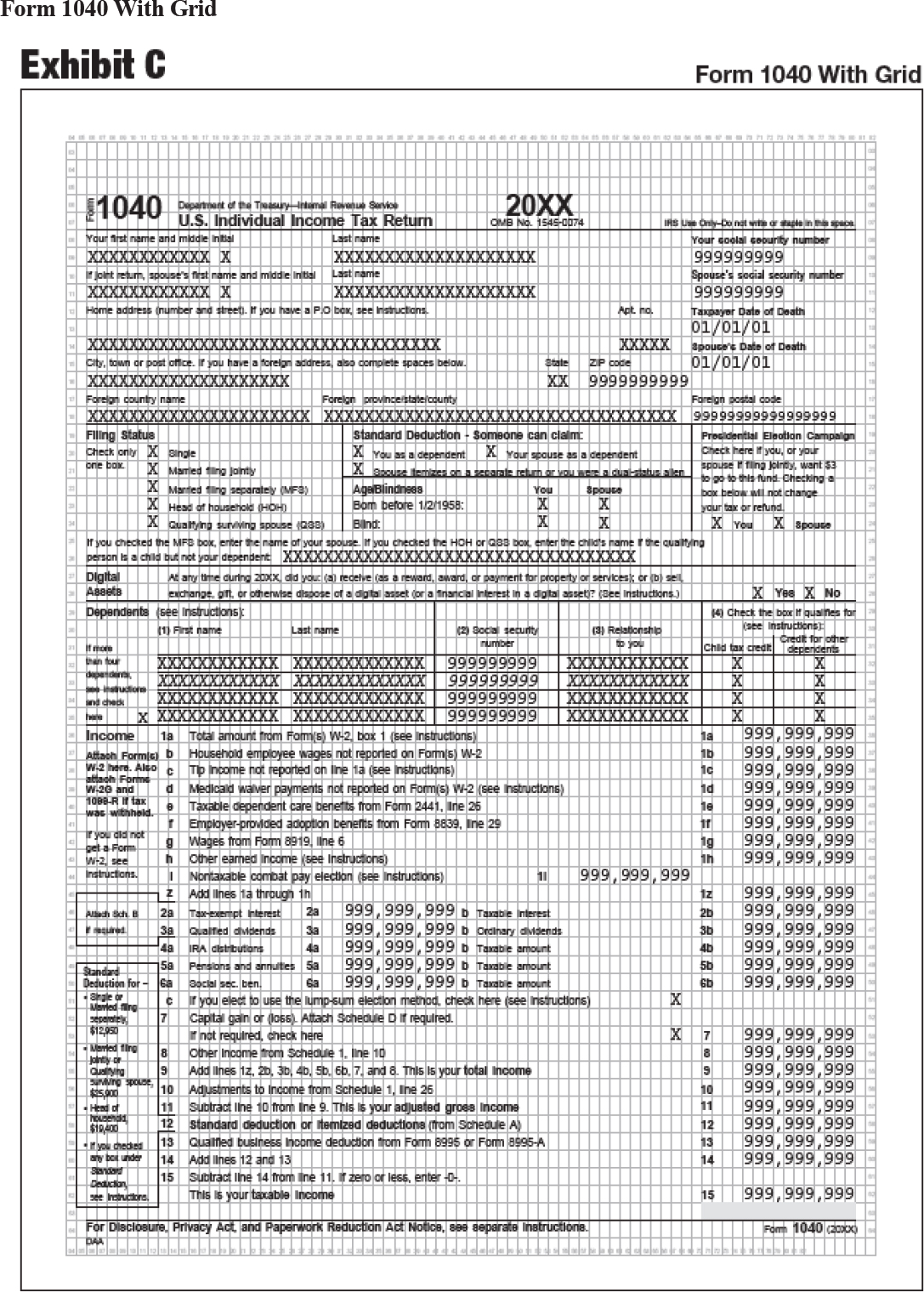

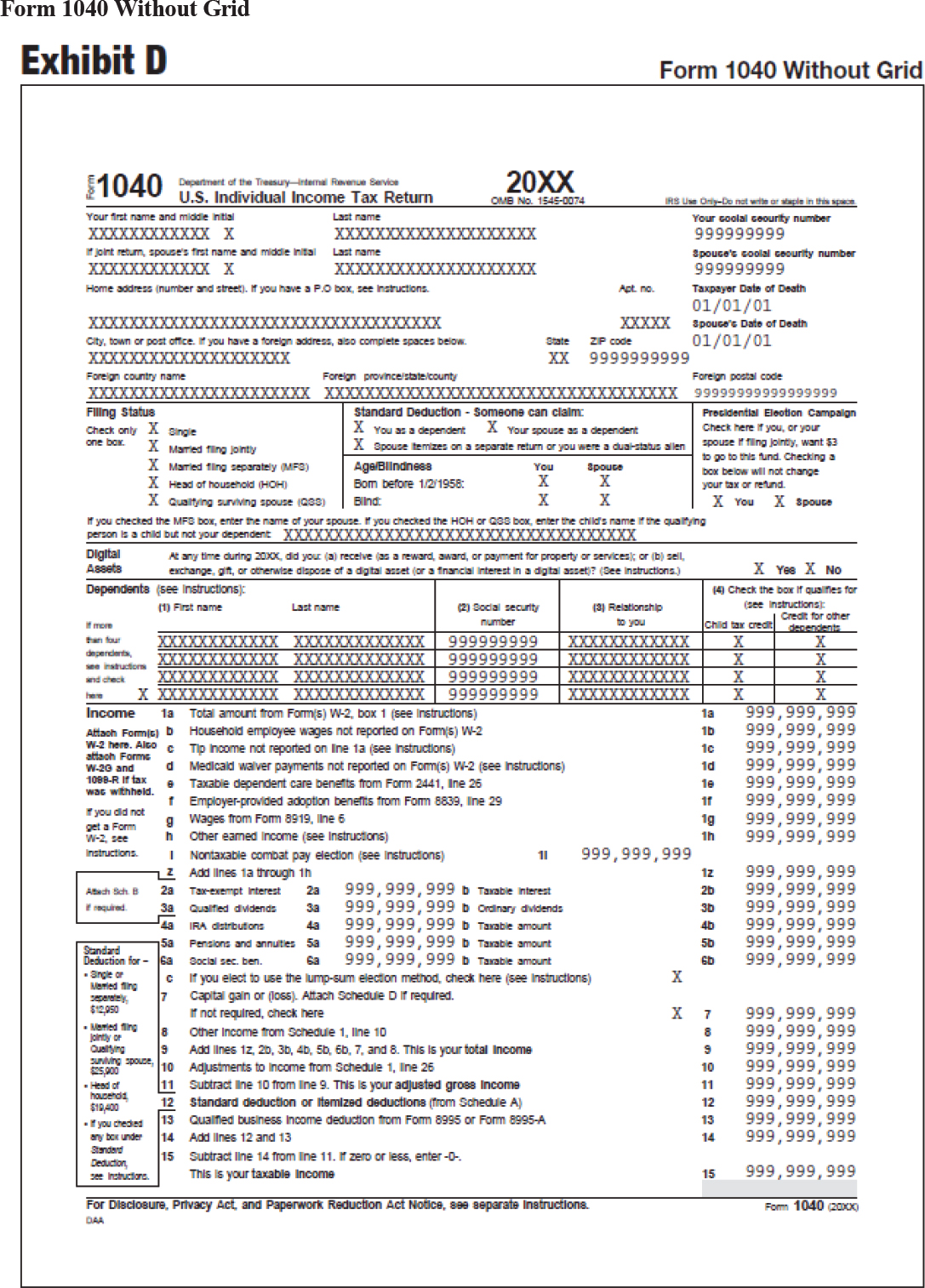

.02 Exhibits. All of the exhibits in this publication were updated per the 2023 revisions of those forms.

.03 Editorial changes. We made editorial changes throughout, including updated references. Redundancies were eliminated as much as possible.

.01 Employers not filing electronically must file paper Forms W-2 (Copy A) along with Form W-3 with the SSA by using either the official IRS form or a substitute form that exactly meets the specifications shown in Parts 2 and 3 of this revenue procedure.

Note. Substitute territorial forms (W-2AS, W-2GU, W-2VI, W-3SS) must also conform to the specifications as outlined in this revenue procedure. These forms require the form designation (“W-2AS,” “W-2GU,” “W-2VI”) on Form W-2 (Copy A) to be in black ink. If you are an employer in the Commonwealth of the Northern Mariana Islands, you must contact Department of Finance, Division of Revenue and Taxation, Commonwealth of the Northern Mariana Islands, P.O. Box 5234 CHRB, Saipan, MP 96950 or www.finance.gov.mp/forms.php to get Form W-2CM and instructions for completing and filing the form. For information on Forms 499R-2/W-2PR, go to www.hacienda.gobierno.pr.

Employers may design their own statements to furnish to employees. Employee statements designed by employers must comply with the requirements shown in Parts 2 and 3.