The Internal Revenue Service (IRS) Data Book is published annually by the IRS and contains statistical tables and organizational information on a fiscal year basis. The report provides data on collecting the revenue, issuing refunds, enforcing the law, assisting the taxpayer, and the budget and workforce.

You can view selected summary graphs, key statistics, and descriptions of the tables and the IRS functions they cover. To download data tables on IRS and taxpayer statistics, visit the relevant section page listed on the left-side navigation column.

View chart details XLSX, or download the IRS Data Book PDF.

Highlights of this year's Data Book

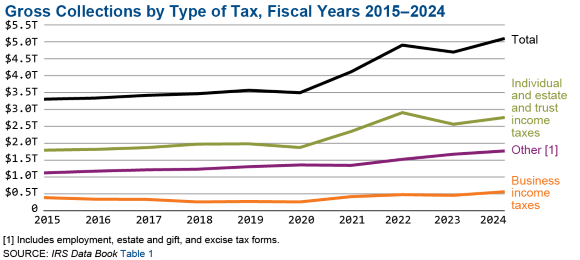

- During Fiscal Year (FY) 2024, the IRS collected more than $5.1 trillion in gross taxes, processed more than 266.6 million tax returns and other forms, and issued nearly $490.6 billion in tax refunds.

- In FY 2024, nearly 62.2 million taxpayers were assisted by calling or visiting an IRS office.

- IRS.gov received approximately 690.0 million visits and taxpayers downloaded about 454.0 million files.

- In FY 2024, the IRS closed 505,514 tax return audits, resulting in over $29.0 billion in recommended additional tax.

Returns filed, taxes collected and refunds issued

Collections, activities, penalties and appeals

Additional applications may be needed to access linked content on this page. Get the free Adobe Acrobat® reader or Excel® viewer.

Did you know?

The PDF version of this year's Data Book PDF offers additional graphs in each section for easier understanding of all the hard work the IRS completes to fund the United States Government and enforce the Nation’s tax laws.

)

или https:// означает, что вы безопасно подключились к веб-сайту, имеющему окончание .gov. Делитесь конфиденциальной информацией только на официальных, безопасных веб-сайтах.

)

или https:// означает, что вы безопасно подключились к веб-сайту, имеющему окончание .gov. Делитесь конфиденциальной информацией только на официальных, безопасных веб-сайтах.