Organizations throughout the country provide free federal and state income tax return preparation and free electronic filing through the VITA and TCE programs to help underserved people in their communities each year.

Get to know the IRS, its people and the issues that affect taxpayers

By Frank Nolden

CL-21-09, March 11, 2021

Did you know that there are thousands of organizations throughout the country that include free income tax return preparation and free electronic filing as one of the services they provide to underserved people in their communities? The Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) programs, run by volunteer organizations nationwide and administered by the IRS through its Stakeholder Partnerships, Education & Communication (SPEC) office, are vital to many American citizens who need to file their federal and state tax returns each year. These programs help millions of low-to-moderate income taxpayers accurately prepare and file their tax returns for free with help from IRS-certified volunteers.

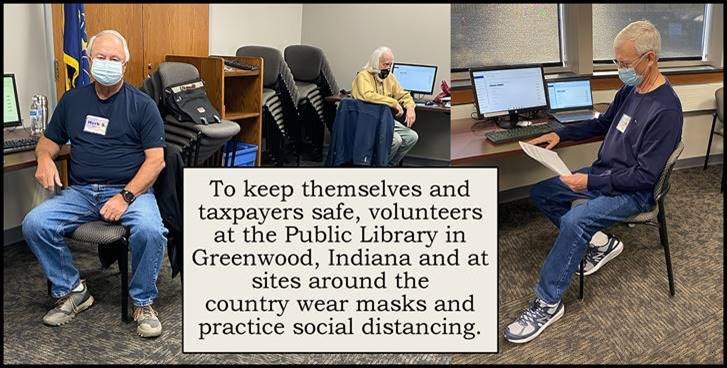

Even though the VITA and TCE programs face unprecedented challenges as the COVID-19 pandemic continues to cause disruptions in service, our partners across the country stand ready to serve taxpayers both in-person and virtually this filing season.

VITA/TCE sites and volunteers

VITA and TCE sites are generally located in community and neighborhood centers, libraries, schools, shopping malls and other convenient locations in many communities. These partners already have relationships with their communities and providing tax return preparation and electronic filing gives our partners one more way to improve the lives of those they serve.

VITA also has a footprint overseas, primarily supporting U.S troops. SPEC conducted its overseas military training using virtual meeting platforms. Seventeen instructors provided training to 17 military bases located in Europe and Asia. As a strong supporter of the VITA program, particularly Military VITA, Commissioner Rettig recently virtually attended several events where he thanked the servicemembers who operate VITA sites on military installations. The Commissioner paid a surprise visit to the servicemembers located outside the country via Zoom – including a “shout out” to those at Camp Casey, S. Korea where the Commissioner’s son was previously stationed – to personally thank them and the IRS personnel for all they were doing to assist with tax preparation. He also attended another Zoom call to celebrate Earned Income Tax Credit (EITC) Awareness Day at the VITA site located at Fort Bliss, Texas that prepares thousands of tax returns for servicemembers and their families each year. Commissioner Rettig thanked the VITA staff, and mentioned his personal connection to Fort Bliss, where his son was previously based while in travel status to another deployment outside the country.

People across the country volunteer to create a better tax filing experience for their clients. Those who help with the VITA/TCE program come from all walks of life: professionals, retirees, college and high school students, IRS employees and many others who want to help in their communities. Many generously sacrifice their evenings and weekends to help others by mentoring, tutoring, advising or finding other ways to provide service, selflessly giving back to their communities. In addition to helping those in need, some volunteers, like high school students, gain practical experience and a view into a potential professional future.

Many VITA/TCE volunteers have several years of service helping taxpayers, including many IRS employees who volunteer their time to help. For example, one of our Deputy Commissioners recently completed training to assist at a VITA site. One of our tax attorneys began volunteering as a college student and continues to this day. The gratitude he regularly receives from those in need, he said, are the reason he’s volunteered for so long. He recalls how some taxpayers even bring baked goods to share with all the volunteers to express their gratitude. He always looks forward to the next filing season.

Certified volunteers sponsored by various organizations, such as The United Way and Economic Assistance Centers, receive different levels of training depending on the types of tax returns they will help prepare in communities across the country. Volunteers can complete their training online via IRS.gov, allowing them to take courses and obtain certification at their own pace. Some of the types of volunteer positions include greeter/screener, interpreter, site administrator/coordinator, tax preparer, quality reviewer, computer specialist/trouble shooter and tax coach. There are opportunities for anyone, at any education level, to help.

For our partners who typically provide in person training, we use more interactive virtual methods, including conference calls and webinars.

VITA/TCE history

The Volunteer Income Tax Assistance program administered by the IRS has a rich history. It began after the Tax Reform Act of 1969 was passed as part of an increased emphasis on taxpayer education. Fifty-two years later, we’re still providing education to taxpayers as well as top quality tax return filing assistance and financial help through various partner programs.

VITA has always provided underserved communities with free tax filing service offered by volunteers trained and certified by the IRS to help low-to moderate-income taxpayers prepare and file tax returns. This also includes the elderly, the disabled and those with limited English proficiency. Since the program started, we remain committed to expanding VITA by recruiting religious, social and non-profit organizations, high schools, the military and other volunteers to provide assistance nationwide.

TCE is mainly for people age 60 or older. Although the program focuses on tax issues unique to seniors, all taxpayers can generally get help from the TCE program. The American Association of Retired Persons (AARP) Foundation participates in the TCE program through AARP Foundation Tax-Aide. They provide training and technical help to volunteers who provide free tax counseling and other forms of assistance to elderly individuals who need help preparing their federal income tax returns.

During VITA’s first filing season, 7,500 volunteers used paper and pencils to prepare about 100,000 returns. Now, more than 80,000 VITA and TCE volunteers operate through more than 11,000 sites using tax preparation software and laptops to prepare and electronically file approximately 3.5 million returns each year.

IRS volunteer grant program

Each year, SPEC’s Grant Program Office awards millions of dollars to organizations that support VITA and TCE programs across the nation, helping to expand VITA services to underserved populations and increase the number of taxpayers able to file electronically. This year, despite many challenges such as the COVID-19 pandemic and implementation of the Taxpayer First Act, we made several significant changes to help grant recipients – our partners – provide help to those in need.

For 2021, the IRS awarded $25 million to 273 VITA applicants and $11 million to 34 TCE applicants. Organizations continue to express a strong interest in participating in the VITA and TCE grant programs as they continue to expand services to underserved communities across the nation.

Modifying our operations

The pandemic has made us think differently about how to deliver the services we provide. We want to make sure taxpayers know they have free options for getting help nearby. While some VITA/TCE sites are not operating at full capacity this year, and others are operating virtually or not at all, many partners are expanding to alternative filing options like Virtual VITA and Facilitated Self-Assistance. We anticipate that more and more taxpayers will take advantage of these resources, and we’re ready to help them. SPEC created Publication 5450, 2021 VITA/TCE Site Operations, for partners and volunteers providing guidance for conducting face-to-face assistance and alternative strategies for preparing tax returns virtually to support taxpayers with timely filing requirements.

Virtual VITA/TCE

A Virtual VITA/TCE site option offers tax preparation remotely. A taxpayer can drop off their tax documents at a partner site or securely upload them to an encrypted web portal. An IRS-certified volunteer contacts the taxpayer via telephone or video chat to gather additional information including validating the taxpayer’s identity. After the volunteer prepares the return, another certified volunteer contacts the taxpayer to conduct a quality review and arrange delivery of the tax documents and a copy of the completed tax return.

Facilitated Self Assistance

Our Facilitated Self Assistance (FSA) lets taxpayers prepare their own taxes and ask questions of a certified VITA/TCE tax coach during the filing process, if needed. It combines the computer skills of the taxpayer, the intuitive programming of the tax software, and the expertise of IRS-certified volunteers to produce an accurate, taxpayer-prepared return. The available software allows taxpayers to file both a free federal and state tax return.

To help partners provide face-to-face service, we modified procedures and will allow them to use grant funds to purchase Personal Protective Equipment. This ensures that both taxpayers and volunteers are safe during any in-person interactions. Funding for additional tax preparation software licenses allows more partners to use the software’s scanned document and Facilitated Self Assistance features that support a reduced contact or contactless service environment. The site review process and the security measures for the reviews have also been revised to allow 100 percent virtual review, if needed.

Let VITA/TCE work for you

Taxpayers may experience longer waits for appointments due to the significant changes in operations to ensure volunteer and taxpayer safety, but taxpayers can locate an open site near them by using the VITA/TCE Locator Tool or the Tax-Aide Site Locator Tool. These tools are updated throughout the filing season, so we encourage anyone in need of help to check again if they don’t see a nearby site listed. Also, please review the other online resources and tax help tools on IRS.gov including IRS Free File – which is free for most taxpayers.

VITA participation is an extremely rewarding experience and a way of giving back to our communities. Interested in volunteering for VITA/TCE or becoming an IRS partner? Please use the VITA/TCE Volunteer and Partner Sign Up on IRS.gov.

Frank Nolden

Director, Stakeholder Partnership, Education and Communications (SPEC)

About the author

Frank Nolden is the Director, Stakeholder Partnerships, Education and Communication in the Wage and Investment (W&I) Division. He is responsible for the delivery of tax education, free return preparation services, and financial education to our nation’s low-income, elderly, disabled, Native American, non-English speaking, and rural taxpayers.

IRS EITC in 2021 YouTube Video

仔细观察

关于纳税人和税务界关注的各种及时问题,请阅读所有我们的帖子 (英文)。

订阅

国税局提供一些关于各种税收主题的电子新闻订阅功能。 订阅(英文)在有新内容发布时,获得电子邮件提醒。

)

或 https:// 表示您已安全连接到 .gov 网站。仅在官方、安全的网站上共享敏感信息。

)

或 https:// 表示您已安全连接到 .gov 网站。仅在官方、安全的网站上共享敏感信息。