This section of the IRS Data Book highlights the IRS’s compliance efforts. Examinations (audits) of most types of tax returns, information reporting and verification, math error notices, and criminal investigations are critical tools to determine if income, expenses, and credits are being accurately reported and to identify and resolve taxpayer errors and to identify fraud. These tools ensure that the IRS has a presence across taxpayers of all income and asset levels.

For the past decade, the IRS has seen an increase in the number of returns filed paired with a decrease in resources available for examinations. The Service is constantly adapting and improving its processes to identify errors, detect fraudulent activity, and ensure resources are allocated as efficiently and effectively as possible. While the IRS accepts most returns as filed, some are selected for examination using various methods, including random sampling and computerized screening. Most IRS examinations are conducted through the mail (correspondence) or face-to-face (field).

The IRS also offers programs that encourage a more proactive approach to ensuring tax compliance for large and international businesses. Tax certainty programs, including the Advance Pricing Agreement (APA) Program and the Compliance Assurance Process (CAP) Program, help taxpayers improve their federal tax compliance via cooperation with the IRS prior to the filing of tax returns.

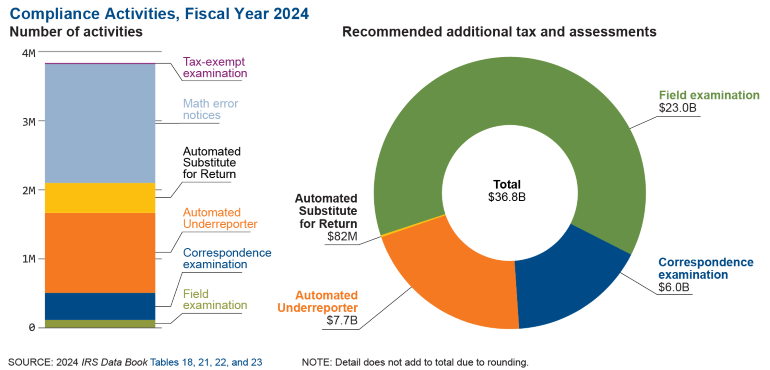

The IRS gathers independent information about income received and taxes withheld from information returns, such as Forms W–2 and 1099 filed by employers and other third parties. The IRS uses this information to verify self-reported income and tax on returns filed by taxpayers. With its Automated Underreporter Program, the IRS matches these information returns to tax returns and contacts taxpayers to resolve discrepancies. In the Automated Substitute for Return Program, the IRS uses information returns from third parties to identify nonfilers; construct tax returns for certain nonfilers based on that third-party information; and assess tax, interest, and penalties based on the substitute returns. To further verify the accuracy of reported information, the IRS also checks for mathematical and clerical errors before refunds are paid.

IRS’s Criminal Investigation function conducts investigations of alleged criminal violations of the tax code and related financial statutes, which may in turn lead to prosecution, fines, and imprisonment.

View chart details XLSX. For additional graphs from this section, download the PDF of this year’s Data Book PDF.

Highlights of the data

- The exam coverage rate for TY 2019 (the most recent year outside the statute of limitations period) of individual taxpayers reporting total positive income (TPI) of $10 million or more was 11.0 percent. The rate for taxpayers with TPI of $5 million–$10 million was 3.1 percent, and 1.6 percent for those with TPI of $1 million–$5 million (Table 17 XLSX).

-

In FY 2024, the IRS closed 505,514 tax return audits, resulting in over $29.0 billion in recommended additional tax (Table 18 XLSX).

- The IRS closed 1.2 million cases under the Automated Underreporter Program in FY 2024, resulting in $7.7 billion in additional assessments. In addition, the IRS closed 442,633cases under its Automated Substitute for Return Program, resulting in nearly $82.0 million in additional assessments (Table 24 XLSX).

- In FY 2024, the IRS completed 2,481 criminal investigations in three areas—896 legal-source tax crime cases, which involve activities, industries, and occupations that generate legitimate income or threats to the tax system; 983 illegal-source financial crime cases, which relate to proceeds derived from unlawful sources such as money laundering; and 602 narcotics-related financial crime cases, which involve investigating narcotics-related tax and money-laundering crimes. These cases are often investigated in cooperation with the Justice Department and other law enforcement agencies (Table 26 XLSX).

Compliance presence: Tables 17–26

Table 24: Information Reporting Program, Fiscal Year 2024 XLSX

Table 25: Math Errors on Individual Income Tax Returns, by Type of Error, Fiscal Year 2024 XLSX

Table 26: Criminal Investigation Program, by Status or Disposition, Fiscal Year 2024 XLSX

Data for all years

Other data book sections

- Returns filed, taxes collected and refunds issued

- Service to taxpayers

- Compliance presence

- Collections, activities, penalties and appeals

- Chief Counsel

- IRS Budget & Workforce

Additional applications may be needed to access linked content on this page. Get free Adobe Acrobat® reader or Excel® viewer.

Return to the IRS Data Book home page

)

或 https:// 表示您已安全連線至 .gov 網站。僅在官方、安全的網站上分享敏感資訊。

)

或 https:// 表示您已安全連線至 .gov 網站。僅在官方、安全的網站上分享敏感資訊。