- HIGHLIGHTS OF THIS ISSUE

- Part I

- Part III

- Update for Weighted Average Interest Rates, Yield Curves, and Segment Rates

- Part IV

- Amounts Paid for Certain Personal Protective Equipment Treated as Medical Expenses

- Definition of Terms

- Numerical Finding List1

- Finding List of Current Actions on Previously Published Items1

- How to get the Internal Revenue Bulletin

Internal Revenue Bulletin: 2021-15

April 12, 2021

These synopses are intended only as aids to the reader in identifying the subject matter covered. They may not be relied upon as authoritative interpretations.

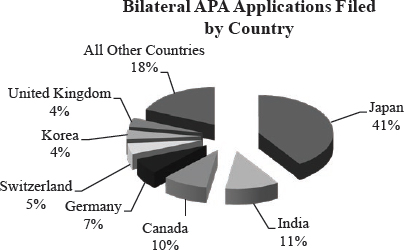

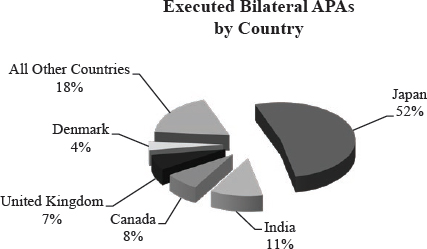

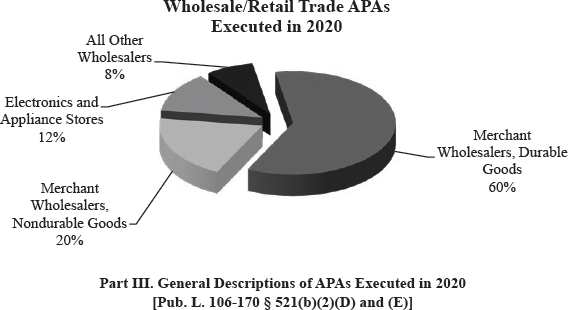

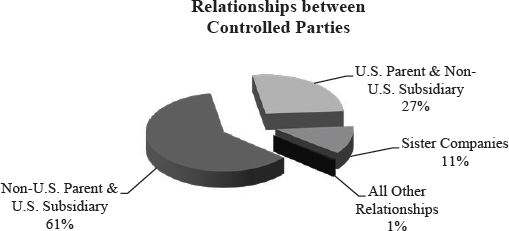

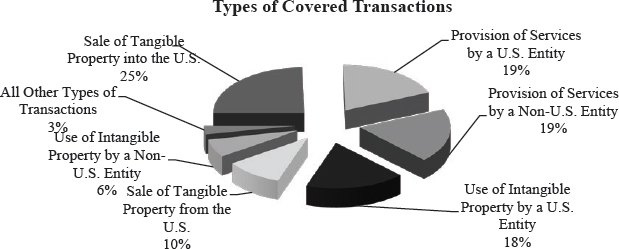

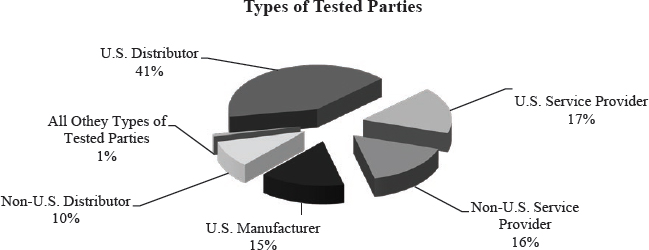

This Announcement is issued pursuant to § 521(b) of Pub. L. 106-170, the Ticket to Work and Work Incentives Improvement Act of 1999, which requires the Secretary of the Treasury to report annually to the public concerning advance pricing agreements (APAs) and the Advance Pricing and Mutual Agreement Program (APMA Program), formerly known as the Advance Pricing Agreement Program (APA Program). This twenty-second report describes the experience, structure, and activities of the APMA Program during calendar year 2020.

This notice provides additional tax relief under section 7508A of the Code for taxpayers affected by the Coronavirus Disease (COVID-19) emergency. Specified Federal income tax filings and payments due on April 15, 2021, are postponed to May 17, 2021. The filing and furnishing of specified Forms 5498 are also postponed to June 30, 2021. Claims for Federal income tax credit or refund that are expiring on or after April 15, 2021, and before May 17, 2021, are also postponed to May 17, 2021. This notice also postpones the application date to participate in the Annual Filing Season Program.

This revenue procedure provides issuers of qualified mortgage bonds, as defined in § 143(a) of the Internal Revenue Code (Code), and issuers of mortgage credit certificates, as defined in § 25(c), with (1) the nationwide average purchase price for residences located in the United States, and (2) average area purchase price safe harbors for residences located in statistical areas in each state, the District of Columbia, Puerto Rico, the Northern Mariana Islands, American Samoa, the Virgin Islands, and Guam.

26 CFR 601.601: Rules and Regulations

(Also Part 1, §§ 25, 143, 6a.103A-1(b)(4), 6a.103A-2(f)(5)).

This notice sets forth updates on the corporate bond monthly yield curve, the corresponding spot segment rates for March 2021 used under § 417(e)(3)(D), the 24-month average segment rates applicable for March 2021, and the 30-year Treasury rates, as reflected by the application of § 430(h)(2)(C)(iv).

Nonacquiescence to the holding that an interest in a defined benefit pension plan is not an asset for purposes of applying the insolvency exclusion in I.R.C. § 108.

Announcement 2021-7 notifies taxpayers that amounts paid for personal protective equipment for the primary purpose of preventing the spread of the Coronavirus Disease 2019 are amounts treated as paid for medical care under § 213(d) of the Internal Revenue Code. As a result, these amounts are qualified medical expenses eligible to be paid or reimbursed without being included in gross income under health flexible spending arrangements (health FSAs), Archer medical savings accounts (Archer MSAs), health reimbursement arrangements (HRAs), or health savings accounts (HSAs). In addition, the announcement notifies administrators of group health plans regarding the ability to make certain plan amendments pursuant to the announcement.

Revenue Procedure 2021-18 provides an automatic procedure for a State or local government in which an empowerment zone is located to extend the empowerment zone designation made under section 1391(a) of the Internal Revenue Code (Code). Specifically, this revenue procedure provides that a State or local government that nominated an empowerment zone is deemed to extend until December 31, 2025, the termination date designated by that State or local government in its empowerment zone nomination (designated termination date), as described in section 1391(d)(1)(B). This revenue procedure further provides the procedure for such State or local government to decline this deemed extension of its designated termination date.

26 CFR 601.105: Examination of returns and claims for refund, credit, or abatement; determination of correct tax liability.

(Also Part I, § 1391.)

This revenue procedure provides guidance with respect to the United States and area median gross income figures for use by issuers of qualified mortgage bonds under § 143(a) of the Internal Revenue Code and issuers of mortgage credit certificates under § 25(c) (collectively, “issuers”) in computing the income requirements under § 143(f). This revenue procedure provides that issuers must use either (1) the income figures the Department of Housing and Urban Development (“HUD”) released most recently or (2) the income figures HUD released immediately prior to the income figures HUD released most recently, determined as of the date a mortgage loan or mortgage credit certificate is committed to a mortgagor. This revenue procedure also provides a 90-day transition period, following the release of the HUD income figures in a current calendar year, for issuers to use the income figures HUD released during the second calendar year prior to the current calendar year..

26 CFR 601.601: Rules and Regulations.

(Also Part I, §§ 25, 143)

Provide America’s taxpayers top-quality service by helping them understand and meet their tax responsibilities and enforce the law with integrity and fairness to all.

The Internal Revenue Bulletin is the authoritative instrument of the Commissioner of Internal Revenue for announcing official rulings and procedures of the Internal Revenue Service and for publishing Treasury Decisions, Executive Orders, Tax Conventions, legislation, court decisions, and other items of general interest. It is published weekly.

It is the policy of the Service to publish in the Bulletin all substantive rulings necessary to promote a uniform application of the tax laws, including all rulings that supersede, revoke, modify, or amend any of those previously published in the Bulletin. All published rulings apply retroactively unless otherwise indicated. Procedures relating solely to matters of internal management are not published; however, statements of internal practices and procedures that affect the rights and duties of taxpayers are published.

Revenue rulings represent the conclusions of the Service on the application of the law to the pivotal facts stated in the revenue ruling. In those based on positions taken in rulings to taxpayers or technical advice to Service field offices, identifying details and information of a confidential nature are deleted to prevent unwarranted invasions of privacy and to comply with statutory requirements.

Rulings and procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents. Unpublished rulings will not be relied on, used, or cited as precedents by Service personnel in the disposition of other cases. In applying published rulings and procedures, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered, and Service personnel and others concerned are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same.

The Bulletin is divided into four parts as follows:

Part I.—1986 Code. This part includes rulings and decisions based on provisions of the Internal Revenue Code of 1986.

Part II.—Treaties and Tax Legislation. This part is divided into two subparts as follows: Subpart A, Tax Conventions and Other Related Items, and Subpart B, Legislation and Related Committee Reports.

Part III.—Administrative, Procedural, and Miscellaneous. To the extent practicable, pertinent cross references to these subjects are contained in the other Parts and Subparts. Also included in this part are Bank Secrecy Act Administrative Rulings. Bank Secrecy Act Administrative Rulings are issued by the Department of the Treasury’s Office of the Assistant Secretary (Enforcement).

Part IV.—Items of General Interest. This part includes notices of proposed rulemakings, disbarment and suspension lists, and announcements.

It is the policy of the Internal Revenue Service to announce at an early date whether it will follow the holdings in certain cases. An Action on Decision is the document making such an announcement. An Action on Decision will be issued at the discretion of the Service only on unappealed issues decided adverse to the government. Generally, an Action on Decision is issued where its guidance would be helpful to Service personnel working with the same or similar issues. Unlike a Treasury Regulation or a Revenue Ruling, an Action on Decision is not an affirmative statement of Service position. It is not intended to serve as public guidance and may not be cited as precedent.

Actions on Decisions shall be relied upon within the Service only as conclusions applying the law to the facts in the particular case at the time the Action on Decision was issued. Caution should be exercised in extending the recommendation of the Action on Decision to similar cases where the facts are different. Moreover, the recommendation in the Action on Decision may be superseded by new legislation, regulations, rulings, cases, or Actions on Decisions.

Prior to 1991, the Service published acquiescence or nonacquiescence only in certain regular Tax Court opinions. The Service has expanded its acquiescence program to include other civil tax cases where guidance is determined to be helpful. Accordingly, the Service now may acquiesce or nonacquiesce in the holdings of memorandum Tax Court opinions, as well as those of the United States District Courts, Claims Court, and Circuit Courts of Appeal. Regardless of the court deciding the case, the recommendation of any Action on Decision will be published in the Internal Revenue Bulletin.

The recommendation in every Action on Decision will be summarized as acquiescence, acquiescence in result only, or nonacquiescence. Both “acquiescence” and “acquiescence in result only” mean that the Service accepts the holding of the court in a case and that the Service will follow it in disposing of cases with the same controlling facts. However, “acquiescence” indicates neither approval nor disapproval of the reasons assigned by the court for its conclusions; whereas, “acquiescence in result only” indicates disagreement or concern with some or all of those reasons. “Nonacquiescence” signifies that, although no further review was sought, the Service does not agree with the holding of the court and, generally, will not follow the decision in disposing of cases involving other taxpayers. In reference to an opinion of a circuit court of appeals, a “nonacquiescence” indicates that the Service will not follow the holding on a nationwide basis. However, the Service will recognize the precedential impact of the opinion on cases arising within the venue of the deciding circuit.

The Commissioner does NOT ACQUIESCE in the following decision:

Schieber v. Commissioner, T.C. Memo. 2017-32, T.C. Docket No. 21690-14.1

1 Nonacquiescence to the holding that an interest in a defined benefit pension plan is not an asset for purposes of applying the insolvency exclusion in I.R.C. § 108.

On March 13, 2020, the President of the United States issued an emergency declaration under the Robert T. Stafford Disaster Relief and Emergency Assistance Act in response to the ongoing Coronavirus Disease 2019 (COVID-19) pandemic (Emergency Declaration). The Emergency Declaration instructed the Secretary of the Treasury “to provide relief from tax deadlines to Americans who have been adversely affected by the COVID-19 emergency, as appropriate, pursuant to 26 U.S.C. 7508A(a).” Pursuant to the Emergency Declaration, this notice provides relief under section 7508A of the Internal Revenue Code (Code) for the persons described in section III.A of this notice that the Secretary of the Treasury has determined to be affected by the COVID-19 emergency.

Section 7508A provides the Secretary of the Treasury or her delegate (Secretary) with authority to postpone the time for performing certain acts under the internal revenue laws for a taxpayer determined by the Secretary to be affected by a Federally declared disaster as defined in section 165(i)(5)(A) of the Code. Pursuant to section 7508A(a), a period of up to one year may be disregarded in determining whether the performance of certain acts is timely under the internal revenue laws.

The Secretary has determined that any person with a Federal income tax return filed on Form 1040, Form 1040-SR, Form 1040-NR, Form 1040-PR, Form 1040-SS, or Form 1040(SP) (Form 1040 series), or a Federal income tax payment reported on one of these forms, that absent this notice would be due April 15, 2021, is affected by the COVID-19 emergency for purposes of the relief described in this section III (Affected Taxpayer). In addition, persons who are required to file and furnish Form 5498, IRA Contribution Information, Form 5498-ESA, Coverdell ESA Contribution Information, and Form 5498-SA, HSA, Archer MSA, or Medicare Advantage MSA Information (Form 5498 series) that absent this notice would generally be due June 1, 2021, are Affected Taxpayers.

The Secretary has also determined that any individual with a period of limitations to file a claim for credit or refund of Federal income tax that absent this notice would expire on or after April 15, 2021, and before May 17, 2021 (for example, certain individual taxpayers with claims for credit or refund in respect of their 2017 taxable years), is an Affected Taxpayer.

For an Affected Taxpayer, the due date for filing Federal income tax returns in the Form 1040 series and making Federal income tax payments in connection with one of these forms having an original due date of April 15, 2021, is automatically postponed to May 17, 2021. Affected Taxpayers do not have to file any form, including Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return, to obtain this relief. This relief includes the filing of all schedules, returns, and other forms that are filed as attachments to the Form 1040 series or are required to be filed by the due date of the Form 1040 series, including, for example, Schedule H and Schedule SE, as well as Forms 965-A, 3520, 5329, 5471, 8621, 8858, 8865, 8915-E, and 8938. Finally, elections that are made or required to be made on a timely filed Form 1040 series (or attachment to such form) will be timely made if filed on such form or attachment, as appropriate, on or before May 17, 2021.

As a result of the postponement of the due date for Affected Taxpayers to file Federal income tax returns and make Federal income tax payments from April 15, 2021, to May 17, 2021, the period beginning on April 15, 2021, and ending on May 17, 2021, will be disregarded in the calculation of any interest, penalty, or addition to tax for failure to file the Federal income tax returns or to pay the Federal income taxes postponed by this notice. Interest, penalties, and additions to tax with respect to such postponed Federal income tax filings and payments will begin to accrue on May 18, 2021.

The postponement of the due date for filing these Federal income tax returns to May 17, 2021, also automatically postpones to the same date the time for Affected Taxpayers to make 2020 contributions to their individual retirement arrangements (IRAs and Roth IRAs), health savings accounts (HSAs), Archer Medical Savings Accounts (Archer MSAs), and Coverdell education savings accounts (Coverdell ESAs). This postponement also automatically postpones to May 17, 2021, the time for reporting and payment of the 10-percent additional tax on amounts includible in gross income from 2020 distributions from IRAs or workplace-based retirement plans.

Forms in the Form 5498 series must be filed with the IRS and furnished to participants and beneficiaries by the due date specified in General Instructions for Certain Information Returns (Forms 1096, 1097, 1098, 1099, 3921, 3922, 5498, and W-2G). Because filers of Form 5498 series are Affected Taxpayers, the due date for filing and furnishing the Form 5498 series is postponed to June 30, 2021. The period beginning on the original due date of those forms and ending on June 30, 2021, will be disregarded in the calculation of any penalty for failure to file those forms. Penalties with respect to such a postponed filing will begin to accrue on July 1, 2021.

The relief provided in this section III.B for filing Federal income tax returns and paying Federal income taxes is available solely with respect to the Form 1040 series returns having an original due date of April 15, 2021, in respect of an Affected Taxpayer’s 2020 taxable year, and the Form 5498 series returns that are due as described above. Businesses and any other type of taxpayer who file Federal income tax returns on forms outside of the Form 1040 series are not Affected Taxpayers for purposes of the relief described in this section III.B.

No extension is provided in this notice for the payment or deposit of any other type of Federal tax, including Federal estimated income tax payments, or for the filing of any Federal return other than the Form 1040 series and the Form 5498 series for the 2020 taxable year.

Individuals with a period of limitations to file a claim for credit or refund of Federal income tax expiring on or after April 15, 2021, and before May 17, 2021, have until May 17, 2021, to file those claims for credit or refund. This postponement is limited to claims for credit or refund properly filed on the Form 1040 series or on a Form 1040-X.

As a result of the postponement of the time for individuals to file claims for credit or refund of Federal income tax where the period to file that claim expires on or after April 15, 2021, and before May 17, 2021, the period beginning on April 15, 2021, and ending on May 17, 2021, will be disregarded in determining whether the filing of those claims is timely.

Revenue Procedure 2014-42, 2014-29 IRB 192, created a voluntary Annual Filing Season Program to encourage tax return preparers who do not have credentials as practitioners under Treasury Department Circular No. 230 (Regulations Governing Practice before the Internal Revenue Service) to complete continuing education courses for the purpose of increasing their knowledge of the law relevant to Federal tax returns. Tax return preparers who complete the requirements in Rev. Proc. 2014-42 receive an annual Record of Completion. Under Rev. Proc. 2014-42, applications to participate in the Annual Filing Season Program for the 2021 calendar year must be received by April 15, 2021. In light of the relief granted in section III of this notice, the 2021 calendar year application deadline is postponed to May 17, 2021.

This notice provides guidance on the corporate bond monthly yield curve, the corresponding spot segment rates used under § 417(e)(3), and the 24-month average segment rates under § 430(h)(2) of the Internal Revenue Code. In addition, this notice provides guidance as to the interest rate on 30-year Treasury securities under § 417(e)(3)(A)(ii)(II) as in effect for plan years beginning before 2008 and the 30-year Treasury weighted average rate under § 431(c)(6)(E)(ii)(I).

This notice does not provide 24-month average segment rates determined under § 430(h)(2)(C)(iv) of the Code reflecting the modifications made by § 9706(a) of the American Rescue Plan Act of 2021, Pub. L. No. 117-2 (ARPA), which was enacted on March 11, 2021. Those rates will be provided in future guidance.

Section 430 specifies the minimum funding requirements that apply to single-employer plans (except for CSEC plans under § 414(y)) pursuant to § 412. Section 430(h)(2) specifies the interest rates that must be used to determine a plan’s target normal cost and funding target. Under this provision, present value is generally determined using three 24-month average interest rates (“segment rates”), each of which applies to cash flows during specified periods. To the extent provided under § 430(h)(2)(C)(iv), these segment rates are adjusted by the applicable percentage of the 25-year average segment rates for the period ending September 30 of the year preceding the calendar year in which the plan year begins.1 However, an election may be made under § 430(h)(2)(D)(ii) to use the monthly yield curve in place of the segment rates.

Notice 2007-81, 2007-44 I.R.B. 899, provides guidelines for determining the monthly corporate bond yield curve, and the 24-month average corporate bond segment rates used to compute the target normal cost and the funding target. Consistent with the methodology specified in Notice 2007-81, the monthly corporate bond yield curve derived from February 2021 data is in Table 2021-2 at the end of this notice. The spot first, second, and third segment rates for the month of February 2021 are, respectively, 0.51, 2.54, and 3.45.

The 24-month average segment rates determined under § 430(h)(2)(C)(i) through (iii) must be adjusted pursuant to § 430(h)(2)(C)(iv) to be within the applicable minimum and maximum percentages of the corresponding 25-year average segment rates. The 25-year average segment rates for plan years beginning in 2020, and 2021 were published Notice 2019-51, 2019-41 I.R.B. 866, and Notice 2020-72, 2020-40 I.R.B. 789, respectively.

The three 24-month average corporate bond segment rates applicable for March 2021 without adjustment for the 25-year average segment rate limits are as follows:

25-YEAR AVERAGE SEGMENT RATES

Section 9706(a) of ARPA changes the 25-year average segment rates and the applicable minimum and maximum percentages used under § 430(h)(3)(C)(iv) of the Code to adjust the 24-month average segment rates. Prior to this change, the applicable minimum and maximum percentages were 90% and 110% for a plan year beginning in 2020, and 85% and 115% for a plan year beginning in 2021, respectively. After this change, the applicable minimum and maximum percentages are 95% and 105% for a plan year beginning in 2020 or 2021. In addition, pursuant to this change, any 25-year average segment rate that is less than 5% is deemed to be 5%.

Pursuant to § 9706(c)(1) of ARPA, these changes apply with respect to plan years beginning on or after January 1, 2020. However, § 9706(c)(2) of ARPA provides that a plan sponsor may elect not to have these changes apply to any plan year beginning before January 1, 2022.2

The rates set forth in this notice do not reflect the changes to § 430(h)(2)(C)(iv) of the Code made by § 9706(a) of ARPA. Accordingly, the adjusted 24-month average segment rates set forth in this notice apply only for plan years for which an election under § 9706(c)(2) of ARPA is in effect. For a plan year for which such an election applies, the 24-month averages applicable for March 2021, adjusted to be within the applicable minimum and maximum percentages of the corresponding 25-year average segment rates in accordance with § 430(h)(2)(C)(iv) of the Code, are as follows:

Section 431 specifies the minimum funding requirements that apply to multiemployer plans pursuant to § 412. Section 431(c)(6)(B) specifies a minimum amount for the full-funding limitation described in § 431(c)(6)(A), based on the plan’s current liability. Section 431(c)(6)(E)(ii)(I) provides that the interest rate used to calculate current liability for this purpose must be no more than 5 percent above and no more than 10 percent below the weighted average of the rates of interest on 30-year Treasury securities during the four-year period ending on the last day before the beginning of the plan year. Notice 88-73, 1988-2 C.B. 383, provides guidelines for determining the weighted average interest rate. The rate of interest on 30-year Treasury securities for February 2021 is 2.04 percent. The Service determined this rate as the average of the daily determinations of yield on the 30-year Treasury bond maturing in November 2050 determined each day through February 10, 2021, and the yield on the 30-year Treasury bond maturing in February 2051 determined each day for the balance of the month . For plan years beginning in March 2021, the weighted average of the rates of interest on 30-year Treasury securities and the permissible range of rates used to calculate current liability are as follows:

In general, the applicable interest rates under § 417(e)(3)(D) are segment rates computed without regard to a 24-month average. Notice 2007-81 provides guidelines for determining the minimum present value segment rates. Pursuant to that notice, the minimum present value segment rates determined for February 2021 are as follows:

The principal author of this notice is Tom Morgan of the Office of the Associate Chief Counsel (Employee Benefits, Exempt Organizations, and Employment Taxes). However, other personnel from the IRS participated in the development of this guidance. For further information regarding this notice, contact Mr. Morgan at 202-317-6700 or Paul Stern at 202-317-8702 (not toll-free numbers).

Table 2021-2 Monthly Yield Curve for February 2021 Derived from February 2021 Data

| Maturity | Yield | Maturity | Yield | Maturity | Yield | Maturity | Yield | Maturity | Yield |

|---|---|---|---|---|---|---|---|---|---|

| 0.5 | 0.18 | 20.5 | 3.22 | 40.5 | 3.48 | 60.5 | 3.58 | 80.5 | 3.63 |

| 1.0 | 0.23 | 21.0 | 3.23 | 41.0 | 3.49 | 61.0 | 3.58 | 81.0 | 3.63 |

| 1.5 | 0.28 | 21.5 | 3.24 | 41.5 | 3.49 | 61.5 | 3.58 | 81.5 | 3.63 |

| 2.0 | 0.35 | 22.0 | 3.25 | 42.0 | 3.49 | 62.0 | 3.58 | 82.0 | 3.63 |

| 2.5 | 0.42 | 22.5 | 3.26 | 42.5 | 3.50 | 62.5 | 3.58 | 82.5 | 3.63 |

| 3.0 | 0.51 | 23.0 | 3.27 | 43.0 | 3.50 | 63.0 | 3.59 | 83.0 | 3.63 |

| 3.5 | 0.61 | 23.5 | 3.28 | 43.5 | 3.50 | 63.5 | 3.59 | 83.5 | 3.63 |

| 4.0 | 0.72 | 24.0 | 3.29 | 44.0 | 3.50 | 64.0 | 3.59 | 84.0 | 3.63 |

| 4.5 | 0.85 | 24.5 | 3.30 | 44.5 | 3.51 | 64.5 | 3.59 | 84.5 | 3.63 |

| 5.0 | 0.98 | 25.0 | 3.31 | 45.0 | 3.51 | 65.0 | 3.59 | 85.0 | 3.63 |

| 5.5 | 1.12 | 25.5 | 3.31 | 45.5 | 3.51 | 65.5 | 3.59 | 85.5 | 3.64 |

| 6.0 | 1.26 | 26.0 | 3.32 | 46.0 | 3.52 | 66.0 | 3.59 | 86.0 | 3.64 |

| 6.5 | 1.41 | 26.5 | 3.33 | 46.5 | 3.52 | 66.5 | 3.60 | 86.5 | 3.64 |

| 7.0 | 1.56 | 27.0 | 3.34 | 47.0 | 3.52 | 67.0 | 3.60 | 87.0 | 3.64 |

| 7.5 | 1.70 | 27.5 | 3.34 | 47.5 | 3.52 | 67.5 | 3.60 | 87.5 | 3.64 |

| 8.0 | 1.84 | 28.0 | 3.35 | 48.0 | 3.53 | 68.0 | 3.60 | 88.0 | 3.64 |

| 8.5 | 1.97 | 28.5 | 3.36 | 48.5 | 3.53 | 68.5 | 3.60 | 88.5 | 3.64 |

| 9.0 | 2.09 | 29.0 | 3.37 | 49.0 | 3.53 | 69.0 | 3.60 | 89.0 | 3.64 |

| 9.5 | 2.21 | 29.5 | 3.37 | 49.5 | 3.53 | 69.5 | 3.60 | 89.5 | 3.64 |

| 10.0 | 2.32 | 30.0 | 3.38 | 50.0 | 3.54 | 70.0 | 3.60 | 90.0 | 3.64 |

| 10.5 | 2.42 | 30.5 | 3.39 | 50.5 | 3.54 | 70.5 | 3.61 | 90.5 | 3.64 |

| 11.0 | 2.51 | 31.0 | 3.39 | 51.0 | 3.54 | 71.0 | 3.61 | 91.0 | 3.64 |

| 11.5 | 2.60 | 31.5 | 3.40 | 51.5 | 3.54 | 71.5 | 3.61 | 91.5 | 3.64 |

| 12.0 | 2.67 | 32.0 | 3.40 | 52.0 | 3.55 | 72.0 | 3.61 | 92.0 | 3.65 |

| 12.5 | 2.74 | 32.5 | 3.41 | 52.5 | 3.55 | 72.5 | 3.61 | 92.5 | 3.65 |

| 13.0 | 2.80 | 33.0 | 3.42 | 53.0 | 3.55 | 73.0 | 3.61 | 93.0 | 3.65 |

| 13.5 | 2.86 | 33.5 | 3.42 | 53.5 | 3.55 | 73.5 | 3.61 | 93.5 | 3.65 |

| 14.0 | 2.90 | 34.0 | 3.43 | 54.0 | 3.55 | 74.0 | 3.61 | 94.0 | 3.65 |

| 14.5 | 2.95 | 34.5 | 3.43 | 54.5 | 3.56 | 74.5 | 3.61 | 94.5 | 3.65 |

| 15.0 | 2.99 | 35.0 | 3.44 | 55.0 | 3.56 | 75.0 | 3.62 | 95.0 | 3.65 |

| 15.5 | 3.02 | 35.5 | 3.44 | 55.5 | 3.56 | 75.5 | 3.62 | 95.5 | 3.65 |

| 16.0 | 3.05 | 36.0 | 3.45 | 56.0 | 3.56 | 76.0 | 3.62 | 96.0 | 3.65 |

| 16.5 | 3.08 | 36.5 | 3.45 | 56.5 | 3.56 | 76.5 | 3.62 | 96.5 | 3.65 |

| 17.0 | 3.10 | 37.0 | 3.45 | 57.0 | 3.57 | 77.0 | 3.62 | 97.0 | 3.65 |

| 17.5 | 3.12 | 37.5 | 3.46 | 57.5 | 3.57 | 77.5 | 3.62 | 97.5 | 3.65 |

| 18.0 | 3.14 | 38.0 | 3.46 | 58.0 | 3.57 | 78.0 | 3.62 | 98.0 | 3.65 |

| 18.5 | 3.16 | 38.5 | 3.47 | 58.5 | 3.57 | 78.5 | 3.62 | 98.5 | 3.65 |

| 19.0 | 3.18 | 39.0 | 3.47 | 59.0 | 3.57 | 79.0 | 3.62 | 99.0 | 3.65 |

| 19.5 | 3.19 | 39.5 | 3.47 | 59.5 | 3.57 | 79.5 | 3.62 | 99.5 | 3.65 |

| 20.0 | 3.20 | 40.0 | 3.48 | 60.0 | 3.58 | 80.0 | 3.63 | 100.0 | 3.66 |

1 Pursuant to § 433(h)(3)(A), the 3rd segment rate determined under § 430(h)(2)(C) is used to determine the current liability of a CSEC plan (which is used to calculate the minimum amount of the full funding limitation under § 433(c)(7)(C)).

2 This election may be made either for all purposes for which the amendments under § 9706 of ARPA apply or solely for purposes of determining the adjusted funding target attainment percentage under § 436 of the Code for the plan year.

This revenue procedure provides issuers of qualified mortgage bonds, as defined in § 143(a) of the Internal Revenue Code (Code), and issuers of mortgage credit certificates, as defined in § 25(c), with (1) the nationwide average purchase price for residences located in the United States, and (2) average area purchase price safe harbors for residences located in statistical areas in each state, the District of Columbia, Puerto Rico, the Northern Mariana Islands, American Samoa, the Virgin Islands, and Guam.

.01 Section 103(a) provides that, except as provided in § 103(b), gross income does not include interest on any State or local bond. Section 103(b)(1) provides that § 103(a) shall not apply to any private activity bond that is not a “qualified bond” within the meaning of § 141. Section 141(e) provides, in part, that the term “qualified bond” means any private activity bond if such bond (1) is a qualified mortgage bond under § 143, (2) meets the volume cap requirements under § 146, and (3) meets the applicable requirements under § 147.

.02 Section 143(a)(1) provides that the term “qualified mortgage bond” means a bond that is issued as part of a qualified mortgage issue. Section 143(a)(2)(A) provides that the term “qualified mortgage issue” means an issue of one or more bonds by a State or political subdivision thereof, but only if: (i) all proceeds of the issue (exclusive of issuance costs and a reasonably required reserve) are to be used to finance owner-occupied residences; (ii) the issue meets the requirements of subsections (c), (d), (e), (f), (g), (h), (i), and (m)(7) of § 143; (iii) the issue does not meet the private business tests of paragraphs (1) and (2) of § 141(b); and (iv) with respect to amounts received more than 10 years after the date of issuance, repayments of $250,000 or more of principal on mortgage financing provided by the issue are used by the close of the first semiannual period beginning after the date the prepayment (or complete repayment) is received to redeem bonds that are part of the issue.

.03 Section 143(e)(1) provides that an issue of bonds meets the purchase price requirements of § 143(e) if the acquisition cost of each residence financed by the issue does not exceed 90 percent of the average area purchase price applicable to such residence. Section 143(e)(5) provides that, in the case of a targeted area residence (as defined in § 143(j)), § 143(e)(1) shall be applied by substituting 110 percent for 90 percent.

.04 Section 143(e)(2) provides that the term “average area purchase price” means, with respect to any residence, the average purchase price of single-family residences (in the statistical area in which the residence is located) that were purchased during the most recent 12-month period for which sufficient statistical information is available. Under §§ 143(e)(3) and (4), respectively, separate determinations of average area purchase price are to be made for new and existing residences, and for two-, three-, and four-family residences.

.05 Section 143(e)(2) also provides that the determination of the average area purchase price shall be made as of the date on which the commitment to provide the financing is made or, if earlier, the date of the purchase of the residence.

.06 Section 143(k)(2)(A) provides that the term “statistical area” means (i) a metropolitan statistical area (MSA), and (ii) any county (or the portion thereof) that is not within an MSA. Section 143(k)(2)(C) further provides that if sufficient recent statistical information with respect to a county (or portion thereof) is unavailable, the Secretary may substitute another area for which there is sufficient recent statistical information for such county (or portion thereof). In the case of any portion of a State which is not within a county, § 143(k)(2)(D) provides that the Secretary may designate an area that is the equivalent of a county. Section 6a.103A-1(b)(4)(i) of the Income Tax Regulations (issued under § 103A of the Internal Revenue Code of 1954, the predecessor of § 143 of the Code) provides that the term “State” includes a possession of the United States and the District of Columbia.

.07 Section 6a.103A-2(f)(5)(i) provides that an issuer may rely upon the average area purchase price safe harbors published by the Department of the Treasury (Treasury Department) for the statistical area in which a residence is located. Section 6a.103A-2(f)(5)(i) further provides that an issuer may use an average area purchase price limitation different from the published safe harbor if the issuer has more accurate and comprehensive data for the statistical area.

.08 Section 25(c) permits a State or political subdivision thereof to establish a qualified mortgage credit certificate program. In general, a qualified mortgage credit certificate program is a program under which the issuing authority elects not to issue an amount of private activity bonds that it may otherwise issue during the calendar year under § 146, and in its place, issues mortgage credit certificates to taxpayers in connection with the acquisition of their principal residences. Section 25(a)(1) provides, in general, that the holder of a mortgage credit certificate may claim a federal income tax credit equal to the product of the credit rate specified in the certificate and the interest paid or accrued during the tax year on the remaining principal of the indebtedness incurred to acquire the residence. Section 25(c)(2)(A)(iii)(III) generally provides that residences acquired in connection with the issuance of mortgage credit certificates must meet the purchase price requirements of § 143(e).

.09 Section 143(f) imposes limitations on the income of mortgagors for whom financing may be provided by qualified mortgage bonds. In addition, § 25(c)(2)(A)(iii)(IV) provides that holders of mortgage credit certificates must meet the income requirement of § 143(f). Generally, under §§ 143(f)(1) and 25(c)(2)(A)(iii)(IV), the income requirement is met only if all owner-financing under a qualified mortgage bond and all mortgage credit certificates issued under a qualified mortgage credit certificate program are provided to mortgagors whose family income is 115 percent or less of the applicable median family income. Section 143(f)(5), however, generally provides for an upward adjustment to the percentage limitation in high housing cost areas. High housing cost areas are defined in § 143(f)(5)(C) as any statistical area for which the housing cost/income ratio is greater than 1.2.

.10 Under § 143(f)(5)(D), the housing cost/income ratio with respect to any statistical area is determined by dividing (a) the applicable housing price ratio for such area by (b) the ratio that the area median gross income for such area bears to the median gross income for the United States. The applicable housing price ratio is the new housing price ratio (new housing average area purchase price divided by the new housing average purchase price for the United States) or the existing housing price ratio (existing housing average area purchase price divided by the existing housing average purchase price for the United States), whichever results in the housing cost/income ratio being closer to 1.

.11 Average area purchase price safe harbors for each state, the District of Columbia, Puerto Rico, the Northern Mariana Islands, American Samoa, the Virgin Islands, and Guam were last published in Rev. Proc. 2020-18, I.R.B. 2020-15, 592.

.12 The nationwide average purchase price limitation was last published in section 4.02 of Rev. Proc. 2020-18. Guidance with respect to the United States and area median gross income figures that are used in computing the housing cost/income ratio described in § 143(f)(5) was published in Rev. Proc. 2021-19, I.R.B. 2021-15 (released on March 25, 2021).

.13 This revenue procedure uses Federal Housing Administration (FHA) loan limits for a given statistical area to calculate the average area purchase price safe harbor for that area. FHA sets limits on the dollar value of loans it will insure based on median home prices and conforming loan limits established by the Federal Home Loan Mortgage Corporation. In particular, FHA sets an area’s loan limit at 95 percent of the median home sales price for the area, subject to certain floors and caps measured against conforming loan limits.

.14 To calculate the average area purchase price safe harbors in this revenue procedure, the FHA loan limits are adjusted to take into account the differences between average and median purchase prices. Because FHA loan limits do not differentiate between new and existing residences, this revenue procedure contains a single average area purchase price safe harbor for both new and existing residences in a statistical area. The Treasury Department and the Internal Revenue Service (IRS) have determined that FHA loan limits provide a reasonable basis for determining average area purchase price safe harbors. If the Treasury Department and the IRS become aware of other sources of average purchase price data, including data that differentiate between new and existing residences, consideration will be given as to whether such data provide a more accurate method for calculating average area purchase price safe harbors.

.15 The average area purchase price safe harbors listed in section 4.01 of this revenue procedure are based on FHA loan limits released December 2, 2020. FHA loan limits are available for statistical areas in each state, the District of Columbia, Puerto Rico, the Northern Mariana Islands, American Samoa, the Virgin Islands, and Guam. See section 3.03 of this revenue procedure with respect to FHA loan limits revised after December 2, 2020.

.16 OMB Bulletin No. 03-04, dated and effective June 6, 2003, revised the definitions of the nation’s metropolitan areas and recognized 49 new metropolitan statistical areas. The OMB bulletin no longer includes primary metropolitan statistical areas.

.01 Average area purchase price safe harbors for statistical areas in each state, the District of Columbia, Puerto Rico, the Northern Mariana Islands, American Samoa, the Virgin Islands, and Guam are set forth in section 4.01 of this revenue procedure. Average area purchase price safe harbors are provided for single-family and two to four-family residences. For each type of residence, section 4.01 of this revenue procedure contains a single safe harbor that may be used for both new and existing residences. Issuers of qualified mortgage bonds and issuers of mortgage credit certificates may rely on these safe harbors to satisfy the requirements of §§ 143(e) and (f). Section 4.01 of this revenue procedure provides safe harbors for MSAs and for certain counties and county equivalents. If no purchase price safe harbor is available for a statistical area, the safe harbor for “ALL OTHER AREAS” may be used for that statistical area.

.02 If a residence is in an MSA, the safe harbor applicable to it is the limitation of that MSA. If an MSA falls in more than one state, the MSA is listed in section 4.01 of this revenue procedure under each state.

.03 If the FHA revises the FHA loan limit for any statistical area after December 2, 2020, an issuer of qualified mortgage bonds or mortgage credit certificates may use the revised FHA loan limit for that statistical area to compute (as provided in the next sentence) a revised average area purchase price safe harbor for the statistical area provided that the issuer maintains records evidencing the revised FHA loan limit. The revised average area purchase price safe harbor for that statistical area is computed by dividing the revised FHA loan limit by 1.03.

.04 If, pursuant to § 6a.103A-2(f)(5)(i), an issuer uses more accurate and comprehensive data to determine the average area purchase price for a statistical area, the issuer must make separate average area purchase price determinations for new and existing residences. Moreover, when computing the average area purchase price for a statistical area that is an MSA, as defined in OMB Bulletin No. 03-04, the issuer must make the computation for the entire applicable MSA. When computing the average area purchase price for a statistical area that is not an MSA, the issuer must make the computation for the entire statistical area and may not combine statistical areas. Thus, for example, the issuer may not combine two or more counties.

.05 If an issuer receives a ruling permitting it to rely on an average area purchase price limitation that is higher than the applicable safe harbor in this revenue procedure, the issuer may rely on that higher limitation for the purpose of satisfying the requirements of §§ 143(e) and (f) for bonds sold, and mortgage credit certificates issued, not more than 30 months following the termination date of the 12-month period used by the issuer to compute the limitation.

.06 Section 4.02 of this revenue procedure sets forth a single nationwide average purchase price for purposes of computing the housing cost/income ratio under § 143(f)(5).

.07 Issuers must use the nationwide average purchase price set forth in section 4.02 of this revenue procedure when computing the housing cost/income ratio under § 143(f)(5) regardless of whether they are relying on the average area purchase price safe harbors contained in this revenue procedure or using more accurate and comprehensive data to determine average area purchase prices for new and existing residences for a statistical area that are different from the published safe harbors in this revenue procedure.

.08 If, pursuant to section 6.02 of this revenue procedure, an issuer relies on the average area purchase price safe harbors contained in Rev. Proc. 2020-18, the issuer must use the nationwide average purchase price set forth in section 4.02 of Rev. Proc. 2020-18 in computing the housing cost/income ratio under § 143(f)(5). Likewise, if, pursuant to section 6.04 of this revenue procedure, an issuer relies on the nationwide average purchase price published in Rev. Proc. 2020-18, the issuer must use the average area purchase price safe harbors set forth in section 4.01 of Rev. Proc. 2020-18 in computing the housing cost/income ratio under § 143(f)(5).

.01 Average area purchase prices for single-family and two to four-family residences in MSAs, and for certain counties and county equivalents are set forth below. The safe harbor for “ALL OTHER AREAS” (found at the end of the table below) may be used for a statistical area that is not listed below.

2021 Average Area Purchase Prices for Mortgage Revenue Bonds

| County Name | State | One-Unit Limit | Two-Unit Limit | Three-Unit Limit | Four-Unit Limit |

|---|---|---|---|---|---|

| ALEUTIANS WEST | AK | $530,235 | $678,770 | $820,497 | $1,019,712 |

| ANCHORAGE MUNIC | AK | $406,066 | $519,826 | $628,334 | $780,907 |

| JUNEAU CITY AND | AK | $469,828 | $601,438 | $727,018 | $903,519 |

| KETCHIKAN GATEW | AK | $395,998 | $506,938 | $612,771 | $761,550 |

| KODIAK ISLAND B | AK | $406,066 | $519,826 | $628,334 | $780,907 |

| MATANUSKA-SUSIT | AK | $406,066 | $519,826 | $628,334 | $780,907 |

| NOME CENSUS ARE | AK | $428,438 | $548,473 | $662,963 | $823,901 |

| SITKA CITY AND | AK | $473,184 | $605,767 | $732,222 | $909,988 |

| SKAGWAY MUNICIP | AK | $403,828 | $516,957 | $624,881 | $776,578 |

| YAKUTAT CITY AN | AK | $409,422 | $524,106 | $633,538 | $787,375 |

| COCONINO | AZ | $379,218 | $485,440 | $586,799 | $729,255 |

| MARICOPA | AZ | $357,964 | $458,253 | $553,921 | $688,400 |

| PINAL | AZ | $357,964 | $458,253 | $553,921 | $688,400 |

| ALAMEDA | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| ALPINE | CA | $450,811 | $577,120 | $697,593 | $866,945 |

| AMADOR | CA | $354,608 | $453,973 | $548,716 | $681,932 |

| CALAVERAS | CA | $363,557 | $465,402 | $562,578 | $699,149 |

| CONTRA COSTA | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| EL DORADO | CA | $581,692 | $744,673 | $900,115 | $1,118,638 |

| HUMBOLDT | CA | $346,778 | $443,905 | $536,606 | $666,854 |

| INYO | CA | $363,557 | $465,402 | $562,578 | $699,149 |

| LOS ANGELES | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MARIN | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MENDOCINO | CA | $430,676 | $551,343 | $666,417 | $828,230 |

| MONO | CA | $514,574 | $658,732 | $796,276 | $989,557 |

| MONTEREY | CA | $719,284 | $920,834 | $1,113,045 | $1,383,269 |

| NAPA | CA | $794,233 | $1,016,745 | $1,229,043 | $1,527,379 |

| NEVADA | CA | $512,336 | $655,863 | $792,823 | $985,277 |

| ORANGE | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| PLACER | CA | $581,692 | $744,673 | $900,115 | $1,118,638 |

| RIVERSIDE | CA | $464,235 | $594,289 | $718,360 | $892,771 |

| SACRAMENTO | CA | $581,692 | $744,673 | $900,115 | $1,118,638 |

| SAN BENITO | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SAN BERNARDINO | CA | $464,235 | $594,289 | $718,360 | $892,771 |

| SAN DIEGO | CA | $732,708 | $938,003 | $1,133,813 | $1,409,095 |

| SAN FRANCISCO | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SAN JOAQUIN | CA | $469,828 | $601,438 | $727,018 | $903,519 |

| SAN LUIS OBISPO | CA | $682,369 | $873,559 | $1,055,946 | $1,312,260 |

| SAN MATEO | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SANTA BARBARA | CA | $642,098 | $822,005 | $993,594 | $1,234,831 |

| SANTA CLARA | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SANTA CRUZ | CA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SOLANO | CA | $535,828 | $685,968 | $829,154 | $1,030,460 |

| SONOMA | CA | $687,963 | $880,709 | $1,064,603 | $1,323,009 |

| STANISLAUS | CA | $385,930 | $494,049 | $597,207 | $742,192 |

| SUTTER | CA | $363,557 | $465,402 | $562,578 | $699,149 |

| VENTURA | CA | $719,284 | $920,834 | $1,113,045 | $1,383,269 |

| YOLO | CA | $581,692 | $744,673 | $900,115 | $1,118,638 |

| YUBA | CA | $363,557 | $465,402 | $562,578 | $699,149 |

| ADAMS | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| ARAPAHOE | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| BOULDER | CO | $636,505 | $814,855 | $984,937 | $1,224,082 |

| BROOMFIELD | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| CHAFFEE | CO | $380,337 | $486,900 | $588,550 | $731,395 |

| CLEAR CREEK | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| DENVER | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| DOUGLAS | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| EAGLE | CO | $799,826 | $1,023,943 | $1,237,700 | $1,538,176 |

| EL PASO | CO | $382,574 | $489,769 | $592,003 | $735,724 |

| ELBERT | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| GARFIELD | CO | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| GILPIN | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| GRAND | CO | $514,574 | $658,732 | $796,276 | $989,557 |

| GUNNISON | CO | $397,117 | $508,348 | $614,522 | $763,690 |

| HINSDALE | CO | $416,133 | $532,715 | $643,947 | $800,264 |

| JEFFERSON | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| LA PLATA | CO | $436,269 | $558,492 | $675,074 | $838,979 |

| LARIMER | CO | $451,930 | $578,531 | $699,344 | $869,085 |

| MONTROSE | CO | $413,896 | $529,845 | $640,493 | $795,936 |

| OURAY | CO | $413,896 | $529,845 | $640,493 | $795,936 |

| PARK | CO | $580,573 | $743,214 | $898,413 | $1,116,498 |

| PITKIN | CO | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| ROUTT | CO | $659,997 | $844,912 | $1,021,317 | $1,269,265 |

| SAN MIGUEL | CO | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SUMMIT | CO | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| TELLER | CO | $382,574 | $489,769 | $592,003 | $735,724 |

| WELD | CO | $417,252 | $534,125 | $645,649 | $802,404 |

| FAIRFIELD | CT | $585,048 | $748,953 | $905,319 | $1,125,107 |

| LITCHFIELD | CT | $347,897 | $445,364 | $538,357 | $669,043 |

| WINDHAM | CT | $354,608 | $453,973 | $548,716 | $681,932 |

| DISTRICT OF COL | DC | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| NEW CASTLE | DE | $419,489 | $536,995 | $649,151 | $806,733 |

| BAKER | FL | $378,100 | $484,030 | $585,096 | $727,115 |

| BROWARD | FL | $391,523 | $501,199 | $605,864 | $752,941 |

| CLAY | FL | $378,100 | $484,030 | $585,096 | $727,115 |

| COLLIER | FL | $447,455 | $572,791 | $692,389 | $860,476 |

| DUVAL | FL | $378,100 | $484,030 | $585,096 | $727,115 |

| MARTIN | FL | $371,388 | $475,421 | $574,688 | $714,226 |

| MIAMI-DADE | FL | $391,523 | $501,199 | $605,864 | $752,941 |

| MONROE | FL | $591,760 | $757,561 | $915,727 | $1,137,996 |

| NASSAU | FL | $378,100 | $484,030 | $585,096 | $727,115 |

| OKALOOSA | FL | $429,557 | $549,884 | $664,714 | $826,090 |

| PALM BEACH | FL | $391,523 | $501,199 | $605,864 | $752,941 |

| ST. JOHNS | FL | $378,100 | $484,030 | $585,096 | $727,115 |

| ST. LUCIE | FL | $371,388 | $475,421 | $574,688 | $714,226 |

| WALTON | FL | $429,557 | $549,884 | $664,714 | $826,090 |

| BARROW | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| BARTOW | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| BUTTS | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| CARROLL | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| CHEROKEE | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| CLARKE | GA | $380,337 | $486,900 | $588,550 | $731,395 |

| CLAYTON | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| COBB | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| COWETA | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| DAWSON | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| DEKALB | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| DOUGLAS | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| FAYETTE | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| FORSYTH | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| FULTON | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| GREENE | GA | $501,150 | $641,563 | $775,508 | $963,780 |

| GWINNETT | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| HARALSON | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| HEARD | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| HENRY | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| JASPER | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| LAMAR | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| MADISON | GA | $380,337 | $486,900 | $588,550 | $731,395 |

| MERIWETHER | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| MORGAN | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| NEWTON | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| OCONEE | GA | $380,337 | $486,900 | $588,550 | $731,395 |

| OGLETHORPE | GA | $380,337 | $486,900 | $588,550 | $731,395 |

| PAULDING | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| PICKENS | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| PIKE | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| ROCKDALE | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| SPALDING | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| WALTON | GA | $401,591 | $514,087 | $621,428 | $772,298 |

| HAWAII | HI | $397,117 | $508,348 | $614,522 | $763,690 |

| HONOLULU | HI | $701,386 | $897,878 | $1,085,371 | $1,348,835 |

| KALAWAO | HI | $703,624 | $900,747 | $1,088,824 | $1,353,163 |

| KAUAI | HI | $700,268 | $896,467 | $1,083,620 | $1,346,695 |

| MAUI | HI | $703,624 | $900,747 | $1,088,824 | $1,353,163 |

| ADA | ID | $403,828 | $516,957 | $624,881 | $776,578 |

| BLAINE | ID | $628,675 | $804,836 | $972,826 | $1,209,005 |

| BOISE | ID | $403,828 | $516,957 | $624,881 | $776,578 |

| CAMAS | ID | $628,675 | $804,836 | $972,826 | $1,209,005 |

| CANYON | ID | $403,828 | $516,957 | $624,881 | $776,578 |

| GEM | ID | $403,828 | $516,957 | $624,881 | $776,578 |

| KOOTENAI | ID | $378,100 | $484,030 | $585,096 | $727,115 |

| OWYHEE | ID | $403,828 | $516,957 | $624,881 | $776,578 |

| TETON | ID | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| VALLEY | ID | $369,151 | $472,552 | $571,235 | $709,898 |

| COOK | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| DEKALB | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| DUPAGE | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| GRUNDY | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| KANE | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| KENDALL | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| LAKE | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| MCHENRY | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| WILL | IL | $369,151 | $472,552 | $571,235 | $709,898 |

| BOONE | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| BROWN | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| HAMILTON | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| HANCOCK | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| HENDRICKS | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| JASPER | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| JOHNSON | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| LAKE | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| MADISON | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| MARION | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| MORGAN | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| NEWTON | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| PORTER | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| PUTNAM | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| SHELBY | IN | $369,151 | $472,552 | $571,235 | $709,898 |

| JOHNSON | KS | $379,218 | $485,440 | $586,799 | $729,255 |

| LEAVENWORTH | KS | $379,218 | $485,440 | $586,799 | $729,255 |

| LINN | KS | $379,218 | $485,440 | $586,799 | $729,255 |

| MIAMI | KS | $379,218 | $485,440 | $586,799 | $729,255 |

| WYANDOTTE | KS | $379,218 | $485,440 | $586,799 | $729,255 |

| BARNSTABLE | MA | $492,201 | $630,085 | $761,647 | $946,563 |

| BRISTOL | MA | $492,201 | $630,085 | $761,647 | $946,563 |

| DUKES | MA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| ESSEX | MA | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| MIDDLESEX | MA | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| NANTUCKET | MA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| NORFOLK | MA | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| PLYMOUTH | MA | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| SUFFOLK | MA | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| WORCESTER | MA | $354,608 | $453,973 | $548,716 | $681,932 |

| ANNE ARUNDEL | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| BALTIMORE | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| BALTIMORE CITY | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| CALVERT | MD | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| CARROLL | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| CECIL | MD | $419,489 | $536,995 | $649,151 | $806,733 |

| CHARLES | MD | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| FREDERICK | MD | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| HARFORD | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| HOWARD | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| MONTGOMERY | MD | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| PRINCE GEORGE’S | MD | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| QUEEN ANNE’S | MD | $523,523 | $670,210 | $810,137 | $1,006,775 |

| TALBOT | MD | $397,117 | $508,348 | $614,522 | $763,690 |

| CUMBERLAND | ME | $392,642 | $502,658 | $607,567 | $755,081 |

| SAGADAHOC | ME | $392,642 | $502,658 | $607,567 | $755,081 |

| YORK | ME | $392,642 | $502,658 | $607,567 | $755,081 |

| ANOKA | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| CARVER | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| CHISAGO | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| DAKOTA | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| HENNEPIN | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| ISANTI | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| LE SUEUR | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| MILLE LACS | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| RAMSEY | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| SCOTT | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| SHERBURNE | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| WASHINGTON | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| WRIGHT | MN | $391,523 | $501,199 | $605,864 | $752,941 |

| BATES | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| CALDWELL | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| CASS | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| CLAY | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| CLINTON | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| JACKSON | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| LAFAYETTE | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| PLATTE | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| RAY | MO | $379,218 | $485,440 | $586,799 | $729,255 |

| FLATHEAD | MT | $368,032 | $471,141 | $569,484 | $707,758 |

| GALLATIN | MT | $465,354 | $595,748 | $720,111 | $894,911 |

| MISSOULA | MT | $378,100 | $484,030 | $585,096 | $727,115 |

| PARK | MT | $366,913 | $469,682 | $567,782 | $705,618 |

| RICHLAND | MT | $346,778 | $443,905 | $536,606 | $666,854 |

| CAMDEN | NC | $446,337 | $571,381 | $690,686 | $858,336 |

| CHATHAM | NC | $425,083 | $544,193 | $657,759 | $817,481 |

| CURRITUCK | NC | $446,337 | $571,381 | $690,686 | $858,336 |

| DARE | NC | $385,930 | $494,049 | $597,207 | $742,192 |

| DURHAM | NC | $425,083 | $544,193 | $657,759 | $817,481 |

| FRANKLIN | NC | $361,320 | $462,533 | $559,125 | $694,869 |

| GATES | NC | $446,337 | $571,381 | $690,686 | $858,336 |

| GRANVILLE | NC | $425,083 | $544,193 | $657,759 | $817,481 |

| HYDE | NC | $469,828 | $601,438 | $727,018 | $903,519 |

| JOHNSTON | NC | $361,320 | $462,533 | $559,125 | $694,869 |

| ORANGE | NC | $425,083 | $544,193 | $657,759 | $817,481 |

| PASQUOTANK | NC | $783,047 | $1,002,446 | $1,211,729 | $1,505,882 |

| PERQUIMANS | NC | $783,047 | $1,002,446 | $1,211,729 | $1,505,882 |

| PERSON | NC | $425,083 | $544,193 | $657,759 | $817,481 |

| WAKE | NC | $361,320 | $462,533 | $559,125 | $694,869 |

| LINCOLN | NE | $421,727 | $539,865 | $652,604 | $811,013 |

| LOGAN | NE | $421,727 | $539,865 | $652,604 | $811,013 |

| MCPHERSON | NE | $421,727 | $539,865 | $652,604 | $811,013 |

| HILLSBOROUGH | NH | $363,557 | $465,402 | $562,578 | $699,149 |

| ROCKINGHAM | NH | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| STRAFFORD | NH | $704,742 | $902,206 | $1,090,575 | $1,355,303 |

| BERGEN | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| BURLINGTON | NJ | $419,489 | $536,995 | $649,151 | $806,733 |

| CAMDEN | NJ | $419,489 | $536,995 | $649,151 | $806,733 |

| CAPE MAY | NJ | $419,489 | $536,995 | $649,151 | $806,733 |

| ESSEX | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| GLOUCESTER | NJ | $419,489 | $536,995 | $649,151 | $806,733 |

| HUDSON | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| HUNTERDON | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MIDDLESEX | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MONMOUTH | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MORRIS | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| OCEAN | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| PASSAIC | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SALEM | NJ | $419,489 | $536,995 | $649,151 | $806,733 |

| SOMERSET | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SUSSEX | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| UNION | NJ | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| WARREN | NJ | $362,439 | $463,992 | $560,827 | $697,009 |

| CATRON | NM | $390,405 | $499,788 | $604,113 | $750,801 |

| LOS ALAMOS | NM | $482,133 | $617,197 | $746,083 | $927,205 |

| SANTA FE | NM | $402,710 | $515,546 | $623,179 | $774,438 |

| CARSON CITY | NV | $369,151 | $472,552 | $571,235 | $709,898 |

| CLARK | NV | $352,371 | $451,103 | $545,263 | $677,652 |

| DOUGLAS | NV | $486,608 | $622,936 | $752,990 | $935,814 |

| STOREY | NV | $447,455 | $572,791 | $692,389 | $860,476 |

| WASHOE | NV | $447,455 | $572,791 | $692,389 | $860,476 |

| BRONX | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| DUTCHESS | NY | $346,778 | $443,905 | $536,606 | $666,854 |

| KINGS | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| NASSAU | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| NEW YORK | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| ORANGE | NY | $346,778 | $443,905 | $536,606 | $666,854 |

| PUTNAM | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| QUEENS | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| RICHMOND | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| ROCKLAND | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SUFFOLK | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| WESTCHESTER | NY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| DELAWARE | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| FAIRFIELD | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| FRANKLIN | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| HOCKING | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| LICKING | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| MADISON | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| MORROW | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| PERRY | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| PICKAWAY | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| UNION | OH | $387,049 | $495,460 | $598,909 | $744,332 |

| BENTON | OR | $418,371 | $535,585 | $647,400 | $804,544 |

| CLACKAMAS | OR | $503,387 | $644,433 | $778,961 | $968,060 |

| CLATSOP | OR | $369,151 | $472,552 | $571,235 | $709,898 |

| COLUMBIA | OR | $503,387 | $644,433 | $778,961 | $968,060 |

| DESCHUTES | OR | $447,455 | $572,791 | $692,389 | $860,476 |

| HOOD RIVER | OR | $464,235 | $594,289 | $718,360 | $892,771 |

| JACKSON | OR | $346,778 | $443,905 | $536,606 | $666,854 |

| MARION | OR | $357,964 | $458,253 | $553,921 | $688,400 |

| MULTNOMAH | OR | $503,387 | $644,433 | $778,961 | $968,060 |

| POLK | OR | $357,964 | $458,253 | $553,921 | $688,400 |

| WASHINGTON | OR | $503,387 | $644,433 | $778,961 | $968,060 |

| YAMHILL | OR | $503,387 | $644,433 | $778,961 | $968,060 |

| BUCKS | PA | $419,489 | $536,995 | $649,151 | $806,733 |

| CARBON | PA | $362,439 | $463,992 | $560,827 | $697,009 |

| CHESTER | PA | $419,489 | $536,995 | $649,151 | $806,733 |

| DELAWARE | PA | $419,489 | $536,995 | $649,151 | $806,733 |

| LEHIGH | PA | $362,439 | $463,992 | $560,827 | $697,009 |

| MONTGOMERY | PA | $419,489 | $536,995 | $649,151 | $806,733 |

| NORTHAMPTON | PA | $362,439 | $463,992 | $560,827 | $697,009 |

| PHILADELPHIA | PA | $419,489 | $536,995 | $649,151 | $806,733 |

| PIKE | PA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| BRISTOL | RI | $492,201 | $630,085 | $761,647 | $946,563 |

| KENT | RI | $492,201 | $630,085 | $761,647 | $946,563 |

| NEWPORT | RI | $492,201 | $630,085 | $761,647 | $946,563 |

| PROVIDENCE | RI | $492,201 | $630,085 | $761,647 | $946,563 |

| WASHINGTON | RI | $492,201 | $630,085 | $761,647 | $946,563 |

| BEAUFORT | SC | $369,151 | $472,552 | $571,235 | $709,898 |

| BERKELEY | SC | $402,710 | $515,546 | $623,179 | $774,438 |

| CHARLESTON | SC | $402,710 | $515,546 | $623,179 | $774,438 |

| DORCHESTER | SC | $402,710 | $515,546 | $623,179 | $774,438 |

| JASPER | SC | $369,151 | $472,552 | $571,235 | $709,898 |

| CANNON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| CHEATHAM | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| DAVIDSON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| DICKSON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| MACON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| MAURY | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| ROBERTSON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| RUTHERFORD | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| SMITH | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| SUMNER | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| TROUSDALE | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| WILLIAMSON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| WILSON | TN | $570,506 | $730,325 | $882,800 | $1,097,141 |

| ATASCOSA | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| BANDERA | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| BASTROP | TX | $404,947 | $518,416 | $626,632 | $778,767 |

| BEXAR | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| CALDWELL | TX | $404,947 | $518,416 | $626,632 | $778,767 |

| COLLIN | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| COMAL | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| DALLAS | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| DENTON | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| ELLIS | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| GUADALUPE | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| HAYS | TX | $404,947 | $518,416 | $626,632 | $778,767 |

| HUNT | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| JOHNSON | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| KAUFMAN | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| KENDALL | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| MEDINA | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| PARKER | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| ROCKWALL | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| TARRANT | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| TRAVIS | TX | $404,947 | $518,416 | $626,632 | $778,767 |

| WILLIAMSON | TX | $404,947 | $518,416 | $626,632 | $778,767 |

| WILSON | TX | $392,642 | $502,658 | $607,567 | $755,081 |

| WISE | TX | $400,473 | $512,677 | $619,677 | $770,158 |

| BOX ELDER | UT | $628,675 | $804,836 | $972,826 | $1,209,005 |

| DAVIS | UT | $628,675 | $804,836 | $972,826 | $1,209,005 |

| JUAB | UT | $427,320 | $547,014 | $661,261 | $821,761 |

| MORGAN | UT | $628,675 | $804,836 | $972,826 | $1,209,005 |

| RICH | UT | $364,676 | $466,861 | $564,329 | $701,289 |

| SALT LAKE | UT | $440,744 | $564,231 | $682,029 | $847,587 |

| SUMMIT | UT | $795,352 | $1,018,204 | $1,230,745 | $1,529,568 |

| TOOELE | UT | $440,744 | $564,231 | $682,029 | $847,587 |

| UTAH | UT | $427,320 | $547,014 | $661,261 | $821,761 |

| WASATCH | UT | $795,352 | $1,018,204 | $1,230,745 | $1,529,568 |

| WASHINGTON | UT | $402,710 | $515,546 | $623,179 | $774,438 |

| WEBER | UT | $628,675 | $804,836 | $972,826 | $1,209,005 |

| ALBEMARLE | VA | $425,083 | $544,193 | $657,759 | $817,481 |

| ALEXANDRIA CITY | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| AMELIA | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| ARLINGTON | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| CHARLES CITY | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| CHARLOTTESVILLE | VA | $425,083 | $544,193 | $657,759 | $817,481 |

| CHESAPEAKE CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| CHESTERFIELD | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| CLARKE | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| COLONIAL HEIGHT | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| CULPEPER | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| DINWIDDIE | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| FAIRFAX | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| FAIRFAX CITY | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| FALLS CHURCH CI | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| FAUQUIER | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| FLUVANNA | VA | $425,083 | $544,193 | $657,759 | $817,481 |

| FRANKLIN CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| FREDERICKSBURG | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| GLOUCESTER | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| GOOCHLAND | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| GREENE | VA | $425,083 | $544,193 | $657,759 | $817,481 |

| HAMPTON CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| HANOVER | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| HENRICO | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| HOPEWELL CITY | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| ISLE OF WIGHT | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| JAMES CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| KING AND QUEEN | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| KING GEORGE | VA | $349,015 | $446,774 | $540,059 | $671,183 |

| KING WILLIAM | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| LANCASTER | VA | $430,676 | $551,343 | $666,417 | $828,230 |

| LOUDOUN | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MADISON | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MANASSAS CITY | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MANASSAS PARK C | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| MATHEWS | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| NELSON | VA | $425,083 | $544,193 | $657,759 | $817,481 |

| NEW KENT | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| NEWPORT NEWS CI | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| NORFOLK CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| PETERSBURG CITY | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| POQUOSON CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| PORTSMOUTH CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| POWHATAN | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| PRINCE GEORGE | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| PRINCE WILLIAM | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| RAPPAHANNOCK | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| RICHMOND CITY | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| SOUTHAMPTON | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| SPOTSYLVANIA | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| STAFFORD | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SUFFOLK CITY | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| SUSSEX | VA | $521,285 | $667,341 | $806,636 | $1,002,495 |

| VIRGINIA BEACH | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| WARREN | VA | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| WILLIAMSBURG CI | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| YORK | VA | $446,337 | $571,381 | $690,686 | $858,336 |

| CHITTENDEN | VT | $369,151 | $472,552 | $571,235 | $709,898 |

| FRANKLIN | VT | $369,151 | $472,552 | $571,235 | $709,898 |

| GRAND ISLE | VT | $369,151 | $472,552 | $571,235 | $709,898 |

| CHELAN | WA | $361,320 | $462,533 | $559,125 | $694,869 |

| CLALLAM | WA | $373,625 | $478,291 | $578,141 | $718,506 |

| CLARK | WA | $503,387 | $644,433 | $778,961 | $968,060 |

| DOUGLAS | WA | $361,320 | $462,533 | $559,125 | $694,869 |

| ISLAND | WA | $419,489 | $536,995 | $649,151 | $806,733 |

| KING | WA | $755,081 | $966,649 | $1,168,442 | $1,452,090 |

| KITSAP | WA | $423,964 | $542,734 | $656,057 | $815,341 |

| PIERCE | WA | $755,081 | $966,649 | $1,168,442 | $1,452,090 |

| SAN JUAN | WA | $484,370 | $620,066 | $749,536 | $931,485 |

| SKAGIT | WA | $394,879 | $505,527 | $611,068 | $759,361 |

| SKAMANIA | WA | $503,387 | $644,433 | $778,961 | $968,060 |

| SNOHOMISH | WA | $755,081 | $966,649 | $1,168,442 | $1,452,090 |

| THURSTON | WA | $394,879 | $505,527 | $611,068 | $759,361 |

| WHATCOM | WA | $430,676 | $551,343 | $666,417 | $828,230 |

| KENOSHA | WI | $369,151 | $472,552 | $571,235 | $709,898 |

| MILWAUKEE | WI | $352,371 | $451,103 | $545,263 | $677,652 |

| OZAUKEE | WI | $352,371 | $451,103 | $545,263 | $677,652 |

| PIERCE | WI | $391,523 | $501,199 | $605,864 | $752,941 |

| ST. CROIX | WI | $391,523 | $501,199 | $605,864 | $752,941 |

| WASHINGTON | WI | $352,371 | $451,103 | $545,263 | $677,652 |

| WAUKESHA | WI | $352,371 | $451,103 | $545,263 | $677,652 |

| JEFFERSON | WV | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| SHERIDAN | WY | $476,540 | $610,047 | $737,426 | $916,408 |

| TETON | WY | $799,948 | $1,024,284 | $1,238,041 | $1,538,614 |

| GUAM | GU | $548,133 | $701,727 | $848,220 | $1,054,098 |

| NORTHERN ISLAND | MP | $510,099 | $652,993 | $789,321 | $980,949 |

| ROTA | MP | $399,354 | $511,218 | $617,975 | $767,970 |

| SAIPAN | MP | $514,574 | $658,732 | $796,276 | $989,557 |

| TINIAN | MP | $517,930 | $663,061 | $801,480 | $996,026 |

| AGUAS BUENAS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| AIBONITO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| BARCELONETA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| BARRANQUITAS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| BAYAMON | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CAGUAS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CANOVANAS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CAROLINA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CATANO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CAYEY | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CEIBA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CIALES | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| CIDRA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| COMERIO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| COROZAL | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| DORADO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| FAJARDO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| FLORIDA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| GUAYNABO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| GURABO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| HUMACAO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| JUNCOS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| LAS PIEDRAS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| LOIZA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| LUQUILLO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| MANATI | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| MAUNABO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| MOROVIS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| NAGUABO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| NARANJITO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| OROCOVIS | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| RIO GRANDE | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| SAN JUAN | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| SAN LORENZO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| TOA ALTA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| TOA BAJA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| TRUJILLO ALTO | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| VEGA ALTA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| VEGA BAJA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| YABUCOA | PR | $374,744 | $479,750 | $579,892 | $720,646 |

| ST. JOHN ISLAND | VI | $606,302 | $776,189 | $938,197 | $1,165,962 |

| ST. THOMAS ISLA | VI | $434,032 | $555,623 | $671,621 | $834,699 |

| All other areas - 2695 counties (floor): | $346,644 | $443,832 | $536,460 | $666,708 |

.02 The nationwide average purchase price (for use in the housing cost/income ratio for new and existing residences) is $331,900.

Rev. Proc. 2020-18 is obsolete except as provided in section 6 of this revenue procedure.