Section 1 of the IRS Data Book provides a broad overview of the main functions performed by the IRS: processing Federal tax returns and collecting revenue. It also provides additional details on returns filed, returns filed electronically, gross collections, and tax refunds by State and type of tax.

View chart details XLSX. For additional graphs from this section, download the PDF of this year’s Data Book PDF.

Highlights of the data

- Individual income tax withheld and tax payments, combined, totaled almost $2.8 trillion before refunds (Tables 1 XLSX and 6 XLSX).

- The IRS also collected nearly $565.1 billion in income taxes, before refunds, from businesses in FY 2024 (Tables 1 XLSX and 6 XLSX).

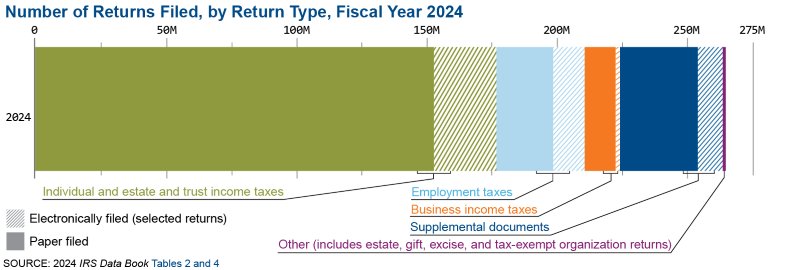

- More than 219.9 million returns and other forms were filed electronically. These represented 82.5% of all filings. For individual tax returns, 93.3% were filed electronically (Table 4 XLSX).

- The IRS issued 117.6 million refunds to individuals in FY 2024, amounting to more than $461.2 billion (Tables 7 XLSX and 8 XLSX).

- In FY 2024, nearly 14.3 million tax refunds included a refundable child tax credit and more than 21.4 million included a refundable earned income tax credit (Table 7 XLSX).

Returns filed, taxes collected and refunds issued: Tables 1–8

Table 1: Collections and Refunds, by Type of Tax, Fiscal Years 2023 and 2024 XLSX

Table 2: Number of Returns and Other Forms Filed, by Type, Fiscal Years 2023 and 2024 XLSX

Table 3: Number of Returns and Other Forms Filed, by Type and State, Fiscal Year 2024 XLSX

Table 4: Number of Returns and Other Forms Filed Electronically, by Type and State, Fiscal Year 2024 XLSX

Table 5: Gross Collections, by Type of Tax and State, Fiscal Year 2024 XLSX

Table 6: Gross Collections, by Type of Tax, Fiscal Years 1960–2024 XLSX

Table 7: Number of Refunds Issued, by Type of Refund and State, Fiscal Year 2024 XLSX

Table 8: Amount of Refunds Issued, Including Interest, by Type of Refund and State, Fiscal Year 2024 XLSX

Data for all years

Other Data Book Sections

- Returns filed, taxes collected and refunds issued

- Service to taxpayers

- Compliance presence

- Collections, activities, penalties and appeals

- Chief Counsel

- IRS Budget & Workforce

Additional applications may be needed to access linked content on this page. Get the free Adobe Acrobat® reader or Excel® viewer.

Return to the IRS Data Book home page

)

oswa https:// vle di ou konekte ak sitwèb .gov san danje. Pataje enfòmasyon sansib sèlman sou sit entènèt ofisyèl ki an sekirite.

)

oswa https:// vle di ou konekte ak sitwèb .gov san danje. Pataje enfòmasyon sansib sèlman sou sit entènèt ofisyèl ki an sekirite.